Further to the earlier piece with my take on future of Cryptocurrency (Cryptos), I got a lot of questions on valuation/price of these currencies and many also opine that this is dangerous & another financial catastrophe is in the offing.

This interested me in having my own point of view which is presented here

Value or price is driven by Demand & Supply dynamics. Presented here is my analysis of what all key factors that determine the value or price of Cryptos

Utility / Purpose factor – What is the utility of the Cryptocurrency ?

For anything to have a value or price, it must have Utility. This is the most important factor that determines the demand & in turn price in the long run.

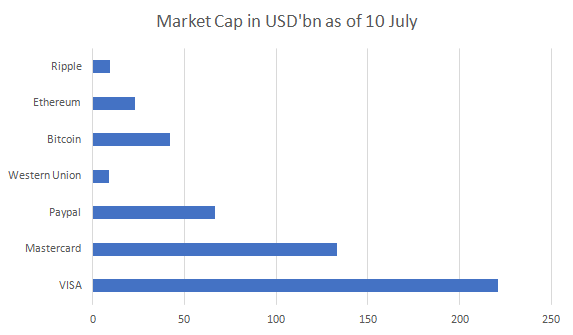

There is a strong opinion that Cryptos are seriously disrupting the world / industry of ‘Payments’ including remittances and that is quite true. They are competing with the likes of Western Union, PayPal, VISA & Mastercard

Distributed ledger technology has been successfully adopted by Blockchain concept and this has resulted in evolution of many more Cryptos. Many of them claim to be a different or better version of Bitcoin.

However quite a few Cryptos have come up with the primary purpose of being used as a token in specific applications and not as a currency. Ethereum & Ripple (# 2 & # 3 in Market cap behind Bitcoin are in this category)

Extracts from the individual websites of Top Cryptos for iterating this point.

- Bitcoin – “Bitcoin allows exciting uses that could not be covered by any previous payment system”

- Ethereum – “Ethereum is a decentralized platform that runs smart contracts”

- Ripple – “Ripple works with banks to transform how they send money around the world”

- Litecoin – “Litecoin is securely stored in a wallet on your computer, tablet, phone or laptop. Start sending and receiving payments with an address and a click”

- Monero – “Private Digital Currency. Monero is a secure, private, untraceable currency. It is open-source and freely available to all. With Monero, you are your own bank. Only you control and are responsible for your funds; your accounts and transactions are kept private from prying eyes”

- Dash – “Use Dash to make instant, private payments online or in-store using our secure open-source platform hosted by thousands of users around the world”

- Sia – “Sia splits apart, encrypts, and distributes your files across a decentralized network. Since you hold the keys, you own your data. No outside company can access or control your files, unlike traditional cloud storage providers”

Adoption Factor – How much of the Cryptos is being / will be adopted in real life?

The Adoption factor is truly the ‘X’ factor. The price / value normally is positively correlated to demand. More adoption means more demand. Most of the cryptos including BTC & ETH are in their early stage adoption.

There is a lot of optimism (including speculation) in this. Only time will tell the degree of usefulness. Growth of e-commerce, penetration of smart phones, mobile Data and mobile based transactions, the pressure on global banks to become more secure, efficient & cost effective have all been a great boost of the Cryptos.

Current valuation reflects factoring in of the size of market a Crypto is going to disrupt – either Top-down by estimating what will be the market share of a Crypto in a given time frame or Bottom-up taking the existing adoption levels of a Crypto and applying estimate growth rate.

I feel, there is a lot of optimism in the current valuation of Cryptos considering the adoption factor. The optimism is stemming from the fact that many companies & the Financial Services industry in general have taken great interest in ‘Testing’ or ‘Experimenting’ with the Cryptos.

Adoption of a Crypto depends on competition for the Crypto as well as the technology. Already competition to Blockchain is emerging in Hyperledger Fabric which does not require Cryptos

Cost Factor

Printing Currency notes by Government is not free and it is part of government’s financial budget. In India it costs around INR 3.54 to print a INR 2000 note & INR 3.09 to print a INR 500 note. In US it costs 19.4cents (INR 13.5) to print $50 note & 15.5cents (INR 10.8) to print $100 note

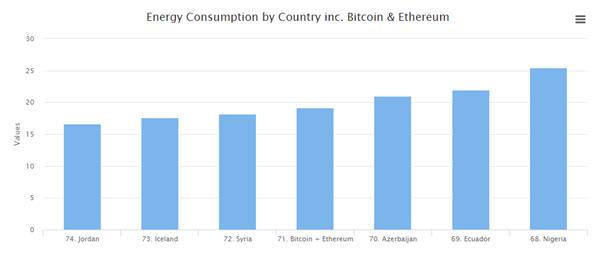

Similarly mining Cryptos is certainly not cheap especially in the early days we are. The most significant cost is the power cost. It is exorbitant and compares to annual power consumption of some countries

Economies of scale & innovation is expected to bring this down over course of time but it must be relatively fast. To reiterate, the energy consumption is for mining and not for transacting with Cryptos. This has a bearing on supply & price

Technology factor

I’m not a technology expert and so will refrain from opining on this topic. However, there are a few technological metrics / KPIs & KRIs that are monitored by the techno experts in evaluating different Cryptos:

Hash Rate – The hash rate of a cryptocurrency is a measure of how many proof of work calculations are being performed by all the miners participating in the network. It is measured in terms of hashes per second, but because such as large number of these calculations are performed it is more usual to see values in larger units such as Gigahashes per second (GHS) or Terrahashes per second (THS).

Difficulty – Difficulty is a parameter of the algorithm used for cryptocurrency mining. It determines how difficult it is to mine a new transaction block and earn its the block reward.

Nodes – Nodes are computers in the network of a cryptocurrency which

- Receive new transactions and blocks

- Validate these transactions and blocks (format, no double spending)

- Spread valid transactions and blocks to connected nodes and ignore invalid transactions and blocks

The availability factor

Cryptos supply is determined by numbers of Cryptos mined or could be mined. Many Cryptos comes with a cap for maximum mining and many don’t. Also, in an unregulated scenario nothing stops these Crypto companies from changing these limits or supply quantity.

Bitcoin has a limit of 21m mining in its lifetime. It is close 16.5m now leaving only 4.5m BTC to be mined in future. Ripple’s promoters have mined all 100bn token but have not released almost 50% keeping the available supply controlled

Inter-dependency Factor

Many Cryptos are interdependent and naturally has a positive correlation to the price movement of the core Crypto. Bitcoin is a key core Crypto and many cryptos have derived from it and hence their pricing is positively correlated to Bitcoin. Many Cryptos have come up in Ethereum platform and are dependent on Ethereum technology as well. Any event in life cycle of Ethereum e.g a technology advancement, breakthrough or a bug or a hack will have a direct impact on dependent Cryptos

Perception Factor

Cryptos’ price/value is highly dependent on perception. It is quite young and not a lot of data points are available to back up theories & projections. Hence a lot is dependent on the perception & vibes that is being created.

Media, Investors, Government & to some extent the ‘Hackers’ all play a role in creating a perception. Interestingly more Cryptos coming up could lead to dilution as well. However, many Cryptos disappearing within months of coming up adds that extra bit of confidence on the ones that is standing strong in this journey

Conclusion

Cryptos are here to stay and most likely will take different shapes & manifestations in the next 3-5 years. As with any new technological thing, there is a lot of uncertainties and optimism at the same time.

With this comes an element of speculation & high volatility in the pricing / valuation. Citing my previous post, the responsibility is on the investor to do due diligence before investing and in this case the responsibility is greater as the proof of the pudding is not well established.

I have presented key factors which I think affects the value / price of a Crypto and in the current scenario the perception factor is weighing heavily.

There are a lot of reports / articles on price predictions but all are on best effort basis and the predictions becomes redundant quite quickly owing to high volatility in the prices.

If you are a risk taker, capitalise on the volatility and the opportunity to make windfall gain / loose entire capital. Market will take time to stabilise and to make investment decisions easier. Till that time enjoy the uncertainty and if you want to play, play safe! 😊

Pingback: Vitalik Buterin Favorite Token Model is OMG (OmiseGO)