Last week, the Asian stock markets came under the pressure after the concerns emerged from the alleged chemical attack in Syria. It rattled the global investor sentiments and gave a blow to the stock market (as it is believed that this attack would increase the oil prices). The tension intensified, but for Indian stock market it was not a scary start therefore investors must focus on undervalued stocks that may bounce back soon.

Though the tremors were felt in the commodity market, but SENSEX (was standing at 34,082 points) was bullish as it identified different reasons to cheer itself up. The top stocks to focus last week were VST industry (the company will be publishing their quarterly results), Dish TV (as it will be signing a block buster deal) and MGL industries ( will sell 10 lakh shares to Shalimar Paints). Though it was a poor start for the day, but there were undervalued stocks.

Undervalued stocks to Buy

Sun Pharmaceutical Industries Limited (NSE:SUNPHARMA)

Currently valued at 516.45, this stock came under the pressure (customer consolidation, the rise in competition, increase in dollar rate or the stringent regulations laid down by the USFDA) due to the general slow- down in the pharma sector and this kneeled down the growth of Sun pharma too. The shares yawned even after the announcement of its new drug approval.

It is believed once the company clears off the Halol plant (non-adherence to the regulations) hurdle, it will soon recover to its stage 1. Even in the later this week Sun Pharma stocks were trading with gain, so buying it is recommended.

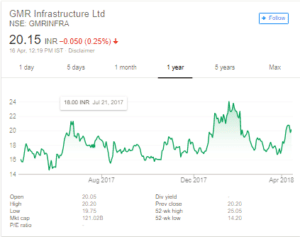

GMR Infrastructure Ltd (NSE:GMRINFRA)

Currently valued at Rs 20.10, Infrastructure giant GMR Infra is facing a challenging time owing to the high inflation rate and sweeping reforms (RERA and GST) made in the year 2018.

The demonetization further nose-dived the demand for the real estate sector even though the government tried to revive the demand by laying impetus on the various schemes but the dent created was irreversible. But it is believed that this stock will gain a momentum as it has a slew of projects (setting up of aerospace and defense manufacturing hub in Tamil Nadu) lined up for it.

GAIL (India) Limited (NSE:GAIL)

Currently valued at Rs 323, GAIL stock is facing a turbulent time due to the current conflict between Syria and United States and this has led to increase in the crude oil , but the government initiatives (Dharmendra Pradhan, gas minister is planning to make India gas based economy and for it he is beefing up the gas infrastructure) will definitely help the stock to remain buoyant irrespective of the current downfall.

ICICI Securities Ltd (NSE:ISEC)

Currently valued at Rs 428, ICICI securities is worth investing for. Though its stock price is hitting low in terms of numbers, but considering its exceptional sales performance and PAT CAGR of 20% and 56% in the last three years, it is believed that the company will offer superior gains.

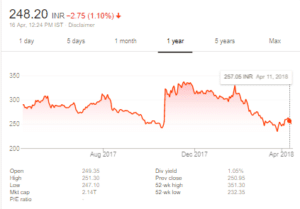

State Bank of India (NSE: SBIN)

currently valued at Rs 248.50, the bank which is too big to fail also came under the pressure after the Nirav Modi scam and over-burdened NPA’s. But it is believed that this is the right time for the investors to invest in this stock because the bank is backed by the state government and has the ability to cover bad debts and increase the valuation in the near future.

Conclusion

In the end, we would like to conclude that the investors should not worry much about the recent developments and should concentrate on the fundamentals of the stock before investing.