Mutual Fund investors have a cause to worry as their investments spiked down by 1-4 percent in last few weeks since IL&FS crisis was uncovered with added effects of weakened INR and falling stock market.

Infrastructure Leasing and Financial Services Limited, popularly known as IL&FS troubles seems to have been surfaced after it has announced the debt of more than 91,000 crore deepened by the liquidity crisis.

This default in payment has raised eyebrows among the investors. Since, public owned company LIC holds a major stake in IL&FS the news has spread like a fire.

The investors who confided mutual funds as the best investment tool are shaken a bit and it is the major reason of market turmoil because a few months back the company garnered AAA- rank and now it has bowed down under the market pressure. This has in turn affected the interest of the investor.

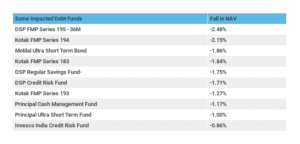

Mutual Funds affected after IL&FS crisis

The net asset value of the below-mentioned scheme haD spiked down by 1-3 percent on Sep 10. Uncertainty has prevailed in and it is believed that more than 33 debt and hybrid mutual have been troubled after this crisis. The worst affected top 6 mutual funds are DSP, Aditya Birla Mf, DSP, LIC MF, Principal MF, HDFC MF and HSBC MF- that accounts for 86% of IL&FS investment.

So, where should the investor invest?

The best way to make the most of the situation is to buy low rate high yielding bonds from the market and keep it aside till the crisis dies its own death.

Other solution is to buy the mutual funds with diversified options. The investors should stay away from debt, non-convertible debentures and hybrid mutual funds with high risk.

This has resulted in a fresh trouble for the mutual fund industry when AMFI is all set to launch and promote the debt mutual fund schemes through its campaign Mutual Fund Sahi Hai. Also, the fall down of IL&FS bombards us with the questions about the ability of rating agencies and the regulator.

The investors are in a doubt how come a top-rated company has lowered down in a matter of weeks. The only solution to this problem is to regularly monitor the credit rating agencies and their published ratings, so as to avoid further mishap.

Hope the Modi government is listening.