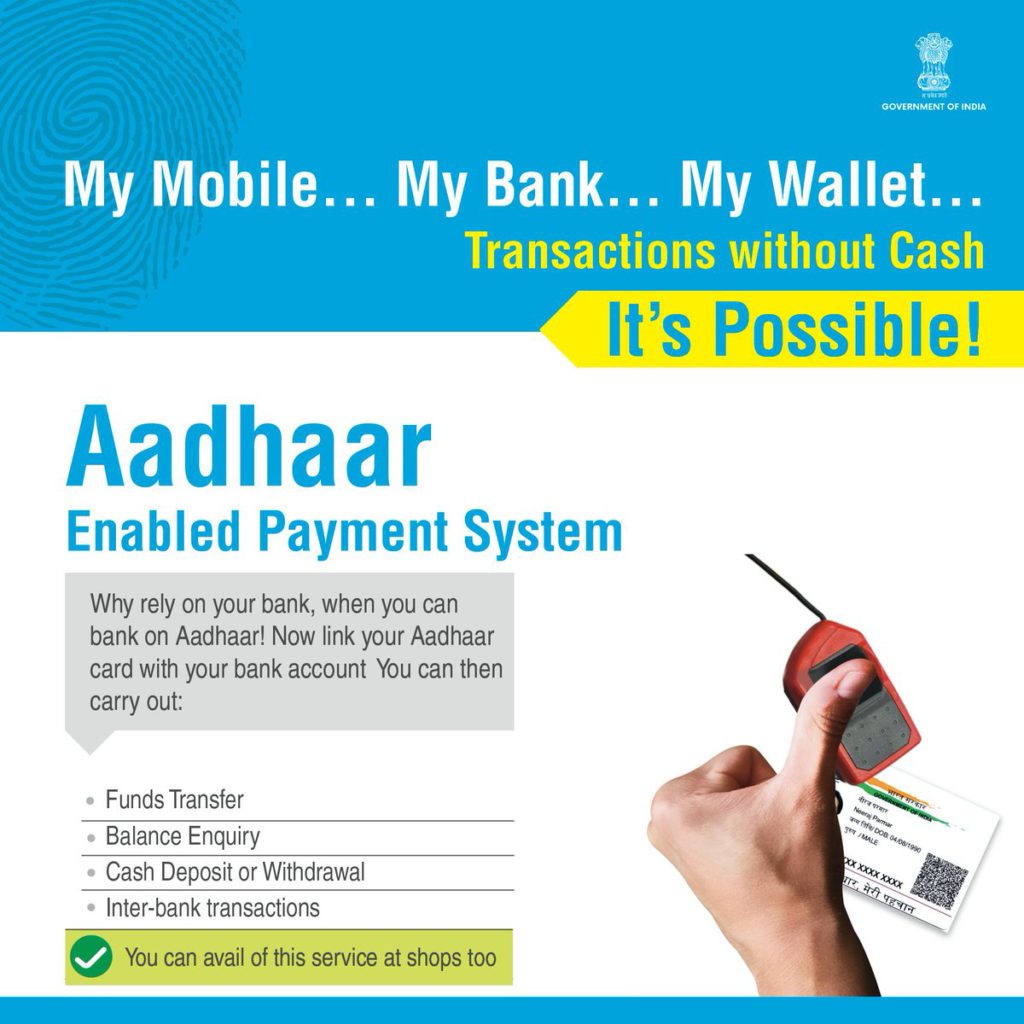

Aadhaar Enabled Payment System or AEPS OR Aadhaar pay finds great acceptance in rural India. Figure shows that AEPS payment rose to 3 folds from December 2016 to April 2017. Certainly a good news for Indian Financial System.

Not that Tough!

AEPS has been hugely welcomed by the rural India as a mode of transaction in the last 6 months. According to the data released by National Payment Corporation of India, the AEPS users in rural India were 2.1 million in December 2016 but in April, 2017, the figure rose to 6 Million. There are 1.3 Lakh Micro ATMs installed in the country out of which 1 lakh are interoperable. Interoperable means that ATM card of any bank can be used in the Micro ATM of any bank.

The figure of 6.1 million AEPS users in April is certainly a very positive news as less than a million people were involved in such transaction before October 2016. Demonetization is certainly the biggest reason for AEPS transactions as it pushed people to embrace new technology.

AEPS more Convenient than other Financial Methods

AP Hota, Chief Executive Officer of NPCI told that NPCI is working with 56 Regional Rural Banks and 53 out of them are already offering interoperable services. He also said that NPCI is working to ensure the rest also get interoperable soon. AEPS offers the people to do transaction of money, transfer fund, check balance and change pin.

The system is very unique and easy to carry out in rural areas where setting up a bank is not that easy. You require a permanent power connection, good road, security system, internet connection and employee willing to work there. This method not only works well, is user friendly but also is economical in nature.

Setting up a traditional banking system is expensive in nature which makes the banks reluctant in installing any branch or ATM in such areas. More than this, a traditional ATM requires 24*7 power connection, security and permanent cash supply which certainly is not feasible in remote areas. Using AEPS is the best way as it is simple and affordable at the same time.

Pingback: Plan your Retirement with Govt Pension Security Plans

Pingback: Bitcoin and Crypto Ban by RBI To Save Existential Crisis for Modi's Plans

Pingback: Axis Bank Share Price Analysis: Buy AXISBANK on Dips and Sell Rallies