Amazon Inc. (NASDAQ:AMZN) is in talks to strengthen its fin tech space and boost its customer offerings. The company is planning to expand its footprint with digital lending startup Capital Float.

The digital lending firm Capital Float is Bangalore based company which focuses on small business. They are ready to start consumer financing on Amazon’s platform. Though the deal size is not yet confirmed but according to sources, the size is not too big. It may invest $5-10million.

E-commerce giant is representing the new trend of shopping as more customers prefer to shop online instead of visiting shops or malls. Amazon offers wide range of variety to its customers.

Amazon has also focused on partnership with some popular brands of clothes and apparel like Nike Inc. (NYSE: NKE) and Calvin klein to attract more customers to their platform.

Amazon Stock Price Analysis

Amazon.com engages in retail sales of consumer products and operates through North America. Company has International presence in consumer retail segment and Amazon web services (AWS). Market cap of the company is $563billion, whereas Beta is 1.39. Current trading price of the stock is 1,168.36 and 52-week high and low range is 1213.41-747.70. Stock is towards its upper range. P/E ratio of the company is 297.71. P/E does not support traditional DCF valuation method but investors must focus on the vision of the company.

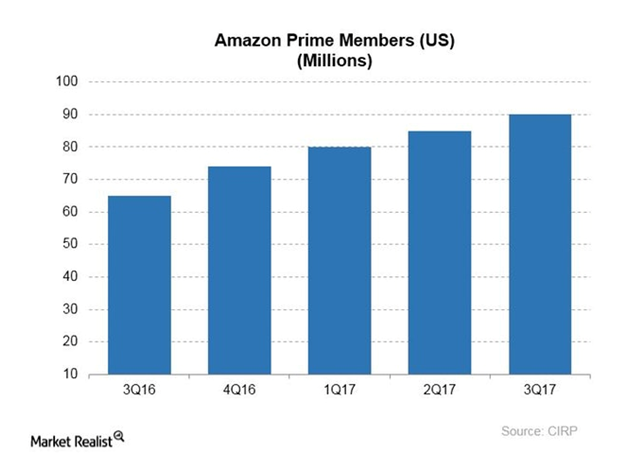

Amazon is contributing by taking many steps towards its growth prospects and fin tech is recent one and Amazon prime offering is one of them. Another one is its focus on growing its private label brands. Company’s prime offering create a new way of convincing its prime customers to spend more. Customers choose to buy private label brands which show significant growth prospect for retailers in this segment.

Analyst rating on Amazon

Analyst ratings is one of the important step for investors, everyone must have a look on analyst rating for the stock in which they intend to invest.

In case of Amazon, 50 analysts who are covering the stock, 47 gave buy rating, 0 sell rating and 3 hold rating. It means 94% analysts are positive on the stock.

Conclusion

Amazon is currently trading at rich valuation with high P/E. Analysts are positive on the stock and future prospect of the company is also bright, at the same time boosting its fin tech space is also a positive sign for the stock.

Disclaimer: The article is in no way an advice to buy or sell any stock; rather it provides a base for the investor’s own research. Consult with a registered investment advisor, prior to making any trading decision of any kind.