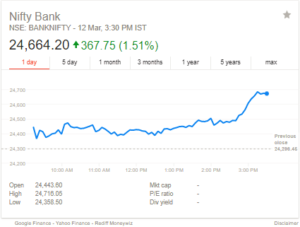

After tightening the noose around the buyers by increasing the interest rates and making the stringent rules for the existing borrowers, the banking sector now seems to be in a recovery mode. Yes! Defying the negative market sentiment, the banking stocks surged up, thus strengthening the Bank Nifty index by 400 points.

What led to the Jump in Bank Nifty?

The firm global market cues, ease of inflation, tightening monetary policy, positivity in the US market swept away the bearish stance from the market, thus taking the stocks to a top-notch level. The major gainers were HDFC bank (up by 0.83 percent), Kotak Bank ( up by 0.38 percent), IndusInd Bank (up by 1.03 percent), Axis Bank (up by 1.02 percent), Yes Bank (up by 0.40 percent), Federal Bank (up by 0.27 percent and the largest private bank ICICI up by 1.37 percent. Thus keeping the Nifty Private Bank Index high by 14,026 points (up by 1.89%)!

The gains in the banking sector, IT sector pushed up the Sensex by 450 points and NIFTY by 190 points.

However, the public sector banks were trading in a negative zone (2844.70, down by 13.45 points). Here’s a chart showing the same

| Public Sector Banks | Down by |

| Andhra Bank | 10.89% |

| IDBI Bank | 2.97% |

| OBC | 3.23% |

| Canara Bank | 2.42% |

| Union Bank of India | 1.71% |

| SBI | 1.11% |

| Allahabad | 0.99% |

| PNB | 0.84% |

| Syndicate | 0.64% |

| Bank of India | 0.20% |

The Nifty PSU bank Index was trading at 1.27 percent down at 2,822 in the morning. The only scrip that was not in the red was Bank of Baroda stock (increased by 0.23%). The stocks like SBI were among the top losers in the Bank Nifty pack of stocks.

PSU Bank Frauds and NPA Mess

The misuse of public funds to shrink the NPA’s and clever accounting and provisioning, has created an obtrusive environment for the growth of public sector banks. Every time the scam is unfolded, too much emphasis is given on the details and the blame game starts. No remedial action is taken, and this leads to the slow bleeding of the banking sector.

The best remedy could be that the PSU banks should be privatized so that there is no poor accountability. Second, there should be stricter NPA norms and third the bankruptcy code norms should be strengthened to recover as much as possible.

The muddled up system wherein the public funds are directed towards the poor quality project is another reason for the same. Hence, the RBI should take a strong action to circumvent the risk and to promote the lost confidence.

In the end, we would like to conclude though the public sector banking stocks are in negative territory, but it is believed that investor could benefit by pouring their money in the stocks like HDFC bank, AXIS bank and IDFC bank. As these are among the most traded stocks to watch.

Pingback: Top Contra Stocks to Buy in India for 2018

Pingback: PNB Share Price To Bounce Back Since Worst is Over?