We all know what blue chip stocks can do to your portfolio. Hence, here we have listed the names of of best blue chip stocks to buy that have stepped up-to the investors’ expectations.

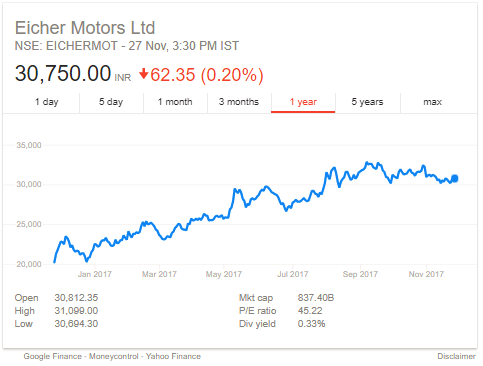

Eicher Motors

Royal Enfield has been in existence since the times when the motorcycles were in demand. Continuing the legacy forward, the flagship brand of Eicher motors has constantly innovated itself to launch the premium products in the market. The company has garnered the appreciation of the riders and critics alike. And the same is shown in its balance sheet.

The consolidated net revenue has increased by 23 percent year on year basis to Rs 2,167 crore as compared to the last quarter. The net sales excluding the duties have grown up by 23.6 percent to Rs 2,161 crore. Thus, creating a halo effect around the stock! With its recent launch of twin cylinder engine bikes (Interceptor 650 Roadster and Continental GT 650) the company plans to grab the lion’s market share.

Back in 2000, the company struggled to find its dominance and it was on verge to shut down its operations however with its devoted customer base the company regained its popularity.

Dr Reddy’s Lab

Though in the current environment the pharma stocks are witnessing pain. The stocks of Dr Reddy and Cadilla health care are trading in a negative territory but despite its weak second quarter results (revenue and profit declined by 1% and 3%) as compared to previous year, the analysts are betting on it.

The reason cited can be the company has made significant investment in R&D and has more than 100 products in pipeline for the US market. This drug maker company also plans to enlarge its customer base by entering into the emerging markets like China, Brazil and Colombia.

Maruti Suzuki

The shares of Maruti Suzuki have swelled 5 times in the last 10 years. Thanks to its constant innovation and its ability to cater to budget friendly market like India. To swim with the currents, the company has announced that it will launch its first electric car in 2 years. Apart from that, it is trading high on the share market, thus making us believe that positivity is in the air. What’s more! With the launch of SUV cars like Vitara Breeza, the company is planning to shed its small car maker tag too.

Ultra Tech Cement

The experts are bullish about Ultra Tech Cement stock because it has been able to build a steady growth rate of 7.28%. Domestic sales volume has been increased by 17.6% while the total volumes have grown by 17.8%. The company has been able to achieve the targeted results due to its superior marketing and logistics services. Going forward, the company focuses on debt reduction and enhancing cash flow management. Thus, giving a positive impression to the investors!

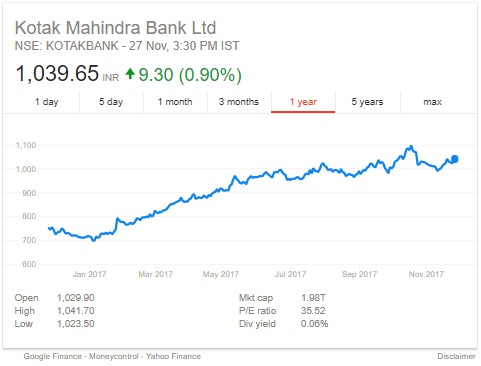

Kotak Mahindra Bank

Kotak Mahindra Bank is sailing high due to its ability to cater to new-age customer demands. Its recent launch of dream different card for those who prefer cash free from banking, and its alliance with block-chain technology company Prime Chain technology is an indicator that the company is growing its technological base too. There has been significant transformation in the Indian economy and the banking sector is going to grow by leaps and bounds.

Parting thoughts

These blue chip stocks have launched the momentum of successful commercialization and they are bound to double the investor money.

Disclaimer: This is author’s personal opinion. Investors are advised to perform their research before investing.