Equity-Linked Savings Schemes (ELSS) are the tax-saving investment that are within this R1.5 lakh limit under Section 80C which gives the benefits of equity returns. ELSS has a reasonable short lock-in period of just three years.

The best ELSS schemes available in the market are Axis Long Term Equity Fund, Aditya Birla Sun Tax Relief 96, Motilal Oswal Long Term Equity Fund & Mirae Asset Tax Saver Fund. Though there are more ELSS available in the market.

ELSS provides the taste of long-term equity returns and for beginners it provides the confidence of investing in mutual funds. There are two other investment options for the investors that provides equity-linked returns, ULIPs and the National Pension System (NPS).

However, ULIPs have long lock-in of at least ten years, along with they have high costs and poor transparency. The second one NPS is a retirement solution rather than a savings one.

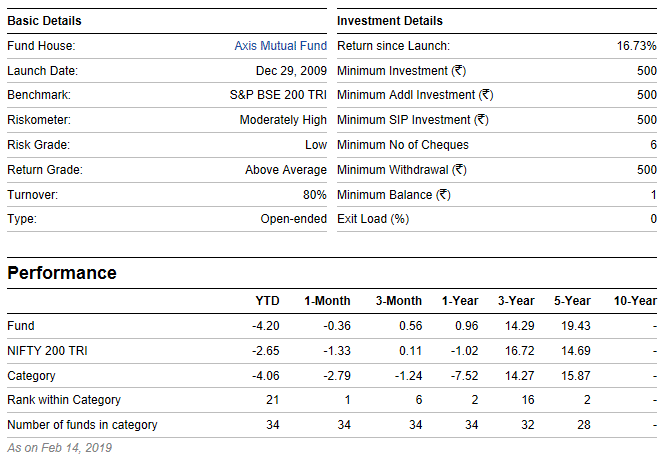

Axis Long Term Equity Fund

The top five sectors in which the fund invests are Financial Services (39.93% holding), Automobile (15.36% holding), Consumer Goods (11.53% holding), IT (10.56% holding) & Chemicals (6.35% holding). The fund has highest holding in HDFC Bank Limited of 8.66% followed by TCS (7.88%) and Kotak Mahindra Bank (6.61%).

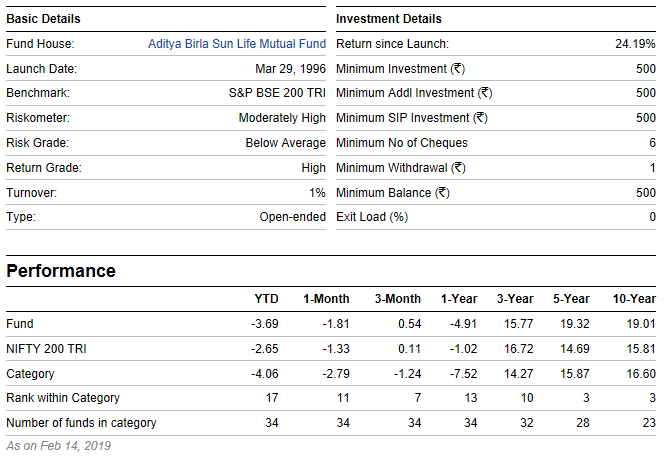

Aditya Birla Sun Tax Relief 96

The top five sectors in which the fund invests are Healthcare (19.62% holding), Financial Services (19.45% holding), FMCG (10.38% holding), Services (10.37% holding) & Automobile (8.66% holding). The fund has highest holding in Reliance Industries of 7.77% followed by Honeywell Automation (7.31%) and Gillette (6.81%).

Motilal Oswal Long Term Equity Fund

The top five sectors in which the fund invests are Financial Services (44.54% holding), Technology (12.38% holding), Automobile (11.68% holding), Energy (7.20% holding) & Healthcare (6.22% holding). The fund has highest holding in HDFC Bank Limited of 8.72% followed by Infosys (6.67%) and HDFC (6.36%).

Mirae Asset Tax Saver Fund

The top five sectors in which the fund invests are Financial Services (30.80% holding), Energy (9.68% holding), Technology (9.15% holding), FMCG (8.74% holding) & Healthcare (7.46% holding). The fund has highest holding in HDFC Bank Limited of 8.21% followed by Axis Bank (5.5%) and Reliance Inds. (5.29%).

Best ELSS Scheme

There are a number of other investments through which the investors gets the tax benefits under Section 80C, this includes EPF (Employees Provident Fund) and PPF (Public Provident Fund). For the very long time, PPF has been India’s most favourite tax-saving vehicle. However, ELSS gives much better results than these two.

Pingback: Should you Ignore Past Returns while Investing in Mutual Fund?