The average return from a SIP view-point in an Equity Mid-Cap fund has crossed the 25% threshold in the last 5 years. Let’s take a look at some of the best equity mutual funds that could help you achieve those dreams of yours in 2018.

There are varied types of Mutual Funds for Indian investors strictly being monitored by the SEBI. Systematic Investment Plan (SIP’s) is one of the best ways to dodge market speculations and gain hefty returns over persistent levels.

The list below captures some of the best performing Equity Mutual Funds and how they could help you attain your dreams and aspirations with consistency and a sound portfolio. The effect of compounding can benefit your investment dramatically thus reaping out some over-the-top returns.

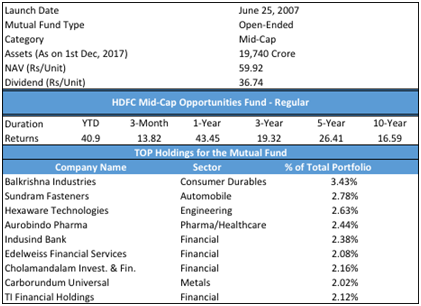

HDFC Mid-Cap Opportunities Fund- Regular Plan

The fund attracts a Risk Rating of “Moderately High” with some bankable stocks in its portfolio. With 40% Returns on a YTD basis, the fund has garnered 18.56% return since its launch. The best part is the consistency in its performance and the robustness with which the managerial team handles the portfolio, while closely monitoring and re-shuffling stocks whenever required.

Since its launch in 2007, an AUM(Asset under Management) of Rs.19,740 Crore has been accumulated. For those investors who want to have a steady investment in a mid-cap equity fund, the portfolio provides exposure to Automobile, Financial Services, and Healthcare sector.

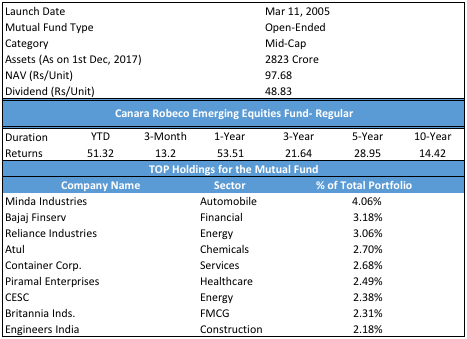

Canara Robeco Emerging Equities Fund – Regular Plan

As a Mid-Cap Equity fund from Canara Robeco, it has garnered 19.48% return since its launch in 2005. Over the 12 years that it has operated on an YTD basis the return has been a whopping 51.32%. The fund has been provided with a 4-star rating by analysts from both Value Research and CRISIL.

The portfolio has exposure to stocks like Minda Industries, Bajaj Finserv, Reliance Industries and provides an encouraging investment from the mid-cap space.

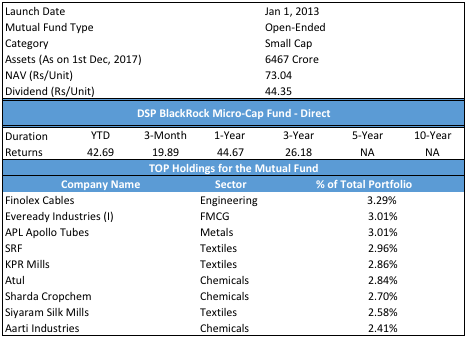

DSP BlackRock Micro-Cap Fund- Direct Plan

In this short span of 4 years, the Micro-cap fund has reaped a return of 32.87%. The fund falls in the “Moderately High” domain in terms of risk being exposed to. Investments in the portfolio include small cap companies like Finolex Cables, Eveready Industries, APL Apollo Tyres all trading at a P/E ratio of more than 30. There are a few Chemical stocks like Atul Ltd., Sharda Cropchem and Aarti Industries with a reasonable valuation in place. For investors vying for Equity Funds pre-dominantly into small cap stocks, this is a good option.

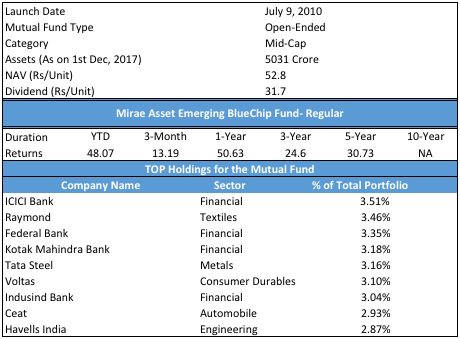

Mirae Asset Emerging Bluechip Fund –Regular Plan

Since its inception in 2010, this Emerging Blue Chip Fund has provided for a propitious return of 24.95%. In terms of an Invested SIP amount, an investment of Rs.1000 every month for 3 years starting 2014 till Dec 2017 would have been Rs. 53,800 over an initial amount of Rs. 36000, equating to a CAGR of 24.6%.

The fund has a consistent exposure to sectors like Banking, Financial Services, Textiles, Consumer Durables, Metals and Engineering. A rating of 5-stars has been fetched by the fund from Value Research and a 4-star rating from CRISIL was bagged for its performance in the last few years.

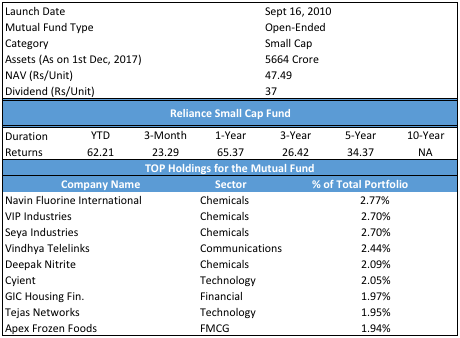

Reliance Small Cap Fund

A discussion about equity mutual funds would be incomplete with the mention of Reliance Small Cap Fund, which has provided 23.8% returns since launch and is ranked 6th in the Small-cap category. An investment of Rs.1000 every month over 3 years would have harvested an investment worth Rs.56,958. The fund remains primarily indulgent in Sectors like Chemicals, Communications, Technology and FMCG.

Equity Mutual Funds- As an Investment

Equity Mutual funds provide for a spectacular platform to individuals who are looking for good returns and are consistent with their plans. Rather than going for fixed income products a “Mutual Fund” helps ensure that your investment is inflation-backed and provides for a portfolio that is reliable in performance. So you get healthy returns considering the momentum from a bull run and a margin of safety when there is a downside risk prevailing.

In lieu of other investment options, if you exit an equity mutual fund after the 365-day window no tax liability is ensued on your profits. Entry in these funds is also eligible for tax rebate under section 80C of the Income tax Act subject to a 3 years lock-in period.

Tracking the performance of a Mutual Fund is very easy and Ms. Radhika Gupta, CEO, Edelweiss Asset Management Ltd. tells you just how. Watch her video here. #MutualFundsSahiHai pic.twitter.com/h371seX8uz

— MutualFunds Sahi Hai (@MFSahiHai) December 27, 2017

Disclaimer: The article is in no way an advice to buy or sell any mutual fund units; rather it provides a base for the investor’s own research. Consult with a registered investment advisor, prior to making any trading/investing decision of any kind.

Pingback: Top 5 Mutual Funds for SIP in India for 2018

Pingback: Best Banking Stocks to Buy as Sensex, Nifty Nosedives

Pingback: Top 5 Debt Mutual Funds for You to Invest in Volatile Indian Market

Pingback: NPS vs. Mutual Funds (SIP): Better Option for Retirement Plan?

Pingback: HDFC AMC IPO Opens on July 25: Should you Invest?

Pingback: PayTm Money App Fails to Impress Users