IT stocks are in demand as the dollar has reached the highest level against a basket of currencies since January 12th on higher US Treasury yields. Further, there is a hope from the summit between North Korea’s Kim Jong Un and South Korean president Moon Jae-in that their decades-long conflict will end.

Global tech shares such as Amazon and Facebook also rallied. European tech shares rose due to the gains in local IT and chip-making companies such as Capgemini, ASML and Infineon. In India, TCS has become the first Indian company to have over USD 100 billion market valuation.

Meanwhile, the IT sector was projected to pay an average hike in salary of 9.5% in 2018. According to the annual Aon India Consulting salary increment survey, the third-party IT services companies, that provide the bulk of the jobs in the IT sector, are projecting an average hike of 6.2%.

Most of the Indian IT stocks are near 52 week highs. However, seeing the potential of the industry, these IT stocks can be added in one’s portfolio.

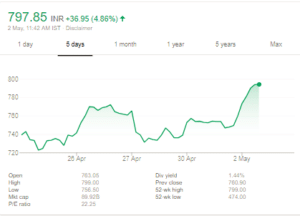

Cyient Ltd (NSE: CYIENT)

Cyient Ltd , step down subsidiary Cyient Europe Ltd. has acquired AnSem N.V., which is a leading fabless, custom analog and mixed-signal application-specific integrated circuits (ASICs) design company. The company acquired Ansem N.V. in an all-cash deal of worth $17 million. AnSem’s mixed-signal analog integrated circuit (IC) capability will enable Cyient to provide turnkey ICs, starting from concept circuit to final production. Cyient expects this transaction to be EPS accretive. Cyient in Q4 FY 18 has posted 11.7% rise in the consolidated profit, which is in line with the estimates.

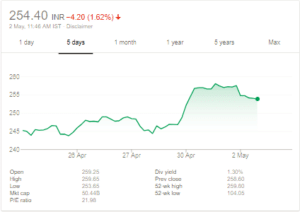

Newgen Software Technologies Ltd (NSE: NEWGEN)

Newgen Software Technologies Ltd businesses has been evolved to several fields such as banking, PSUs, insurance and healthcare etc. The company has established recognition in the industry and does innovation through its in-house R&D operations. The company’s H1FY18 annualised earnings is higher compared to its peers like Intellect Design Arena.

KPIT Technologies Ltd (NSE: KPIT)

KPIT Technologies Ltd in the third quarter has posted 15% growth in the USD Revenues at $ 141 Million on yoy basis. The company’s EBITDA margins stood at 10.84% compared to 9.8% last quarter. Over the last couple of quarters the company had taken cost reduction actions and now the company is seeing the benefits of those actions in the actual numbers.

Pingback: TCS Share Price Outlook after Buyback Proposal on Board