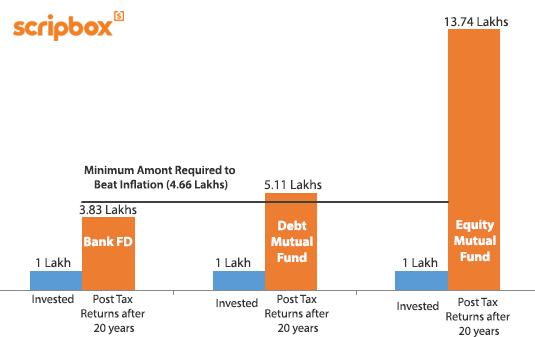

Nifty is trading at a price –to-earnings ratio of 25.96 times of its 10 years historical average, the investors are made to believe that the Debt Funds is a way superior option than the Fixed Deposits. Is it so? Well, let’s put an end to the confusion related to best investment options for you.

Debt Funds vs. Mutual Funds

Interest Rate

We all know, a debt fund is the best way to battle against inflation and research pinpoints it too. When it comes to interest rate card, generally the banks offer 7%p.a on FD, whereas the short terms funds are able to generate around 10.13% p.a. Thus, making debt funds as a clear winner!

Regular Returns

The debt funds are categorized into liquid funds, ultra short term funds, floating rate and corporate bonds on basis of tenure, risk taking capacity and tax implication. There are certain debt instruments like Treasury Bills, Government security, Corporate Bonds, Money market instruments that offer fixed income security, thus they put an end to the myth that debt funds doesn’t deliver fixed returns.

| Ultra-short term Debt Funds | Returns over last 1-year |

| Kotak Banking & PSU | 9.48% |

| Franklin India Ultra-short Bond Fund — Super Institutional Plan | 9.36% |

| BOI AXA Treasury Advantage Fund — Regular Plan | 8.85% |

| L&T Floating Rate Fund | 8.80% |

| Birla Sun Life Floating Rate Fund — Long Term Plan | 8.76% |

| Source: www.paisabazaar.com

Ultra-short term debt funds are best suited for investment horizons of 3–12 months. |

|

Source-Money Control

Risk

Though the short term debt funds deliver pretty good returns but there is a risk associated with it. For instance, the recent news of a rise in bond yields has shaken up the conservative debt mutual fund investors who have recently invested in debt mutual funds with an aim to get more returns. Some other investors who invested their money in long-term debt schemes are also in a state of shock because suddenly the wealth advisers have started recommending ultra short term schemes and short term schemes.

Call it as an aftereffect of Indian bond yields (that spiraled up to their highest in 14 months), rising inflation or high global oil prices, the debt funds have become riskier for the investors.

The benchmark yield has dipped to 16 basis points and the government has cancelled the sale of the bonds through the open market operation.

So, what are the Best Investment Options?

Here we are not trying to recommend you to buy a FD instead of debt funds for healthy investment portfolio. Rather we are trying to suggest you to go for simple debt schemes that offer low risk, especially if you don’t understand a lot about the debt schemes.

“Match your investment horizon with the duration of your fund, in case of duration funds. Don’t go for a long-term or medium term bond fund if you need the money after one year, stick to short-term,” says Gaurav Monga.

Another tip- If you are unaware of the universe of debt schemes, go for liquid or short term funds.

In the end, we would like to conclude don’t make an investment in debt funds without making a proper research.

Pingback: Ganesh Films IPO Opens Today, Should You Invest?

Pingback: Bank Fixed Deposit Vs. Corporate FD, Risk and Returns