Thanks to the government’s UDAY scheme (Ujwal Discom Assurance Yojana), the power sector has registered the growth in the last couple of years. The scheme has helped the companies to lower down the losses from Rs 51,600 crore in 2015-16 to Rs 19,000 crore in 2017-18.

Various brokerage houses including Reliance Securities and EmKay are positive on this sector. Hence, the investors are recommended to invest in the below-mentioned power stocks to give their portfolio a new boost.

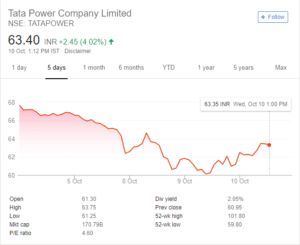

Tata Power

Though Tata Power Company stocks are down by 0.08% and has lost more than 16.73% in the last one month, but still the stock is worth investing for because the company is putting a step forward to lower down its debt by reviving MW Mudra Plant.

According to the Bloomberg, the company has a strong foothold in the power sector and the stock price may gain momentum by 34% in the next few years. Needless, to mention the company has even bagged two awards at 7th ACEF Asian Leadership.

Even the company is planning to offer a wide range of solar power services (starting from installation to financing) to increase its usage.

Power Grid Corporation

You may be tempted to sell the bright stock of the government of India if you are comparing it with the peers, but it is believed the stock is expected to exceed the market potential in the coming years. It has already registered the earnings growth rate of 7.7% coupled with higher capitalization, huge CAPEX pipeline, steady ROE.

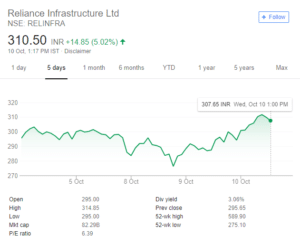

Reliance Infrastructure

The recent blood-shed in the domestic market has not only hurt the retail investor sentiment but has devastated the top billionaires too. The second most valued stock RIL has recorded a loss of 40% of its market capitalization in this year, but there is a reason to stay invested in this stock because the company growth momentum is high and is in talks with various other companies to add a feather on its cap.

Bharat Heavy Electrical

The company is trading on a positive zone. The stock price reported is Rs 73.10, which has increased by 3.00 points from last one day. If that’s not what will you stay invested in this stock, there are other reasons too

- The company has bagged four orders worth Rs 2900 crore from NTPC

- It has won various safety awards

In the end, we would like to conclude that these stocks require a market trigger and they main gain high over the next few years.