It’s really a tough job to pick best small cap stocks, especially when the market is at peak. However, here we have picked some very good small cap shares which may give good returns as Investors always want to invest in small cap stocks for quick returns.

Here we will focus on those small caps stocks which are fundamentally strong. These stocks may make you panic by it’s volatility at times. But if the stock’s fundamentals are strong , they will always give you great return. So, these stocks are;

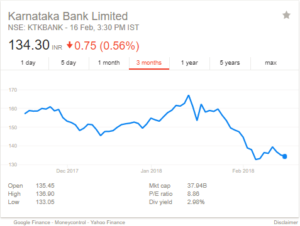

Karnataka Bank

Karnataka Bank ltd. is a private sector company, which is a mid size bank. It has 9.4 million customers with 781 branches.

The company has been reporting good results from past few quarters. The company’s turnover touched Rs. 1, 02,182 crores. For nine months ended 31 Dec. 2017, Interest income increased 2% to Rs. 39.81 B. Net profit surged to Rs. 87.38 Crores from Rs. 68.52 Crores corresponding to the same period of last year. NPA of the company also reduced from 4.30% in FY 2016 to 3.96 % in year ending 2017.

P/E of the company is 8.32, while the industry P/E is 29.13. Expected EPS of the company for FY 2018-19 is Rs. 18. All above shows an upside potential for the company.

Cyient ltd

The Company provides global service in engineering design, manufacturing, networks and operations.

On financial side, P/E of the company is 18.45 while the peers TCS has 23.03 P/E and HCL has 18.04 P/E, while EPS of the company is 33.49. Dividend yield is 1.86%. So, as per its valuation point of view it looks great to invest.

Granules India

Granules India is a pharmaceutical company based in Hyderabad India. Its presence is from pharmaceutical ingredients to pharmaceutical formulation and finished dosages.

Over the last few years, financial performance of the company is quiet decent. Net profit increased from Rs. 123 cr. In FY 2016 to Rs. 164.5 cr. In FY 17. The performance of the company will further rise in next two years due to its expansion plan.

P/E ratio of the company is 18.89 while the P/E of industry is 29.93. EPS of the company is 6.22 with market cap. of Rs.2,982 cr.

Aban Offshore

The Company is engaged in providing offshore drilling services for exploration, development and production of oil and gas domestically and in international market.

On the financial side, company reported a net profit of Rs. 6.40 Crores in quarter ending 30th sep. 2017. Due to its small equity capital, company has Rs. 10.96 EPS.

The expected EPS for FY 2018-19, which company can achieve is Rs. 20. It shows that the company has the potential to do well in coming years also.

Above four small cap stocks are a good buy in 2018 for investors who want to invest in stock market with higher risk appetite.

Disclaimer- The content is provided for informational purposes only and it is not intended to be, and does not, constitute financial advice or any other advice. You should not rely on the content to make an investment decision.

Pingback: Hindcon Chemicals IPO Review, Should You Invest?