ELSS investments are subject to tax deduction upto Rs 1.5 lakh. Here, in this article, we have enlisted top 5 ELSS or tax saving mutual funds that can do wonders for your portfolio.

Equity Linked Saving Scheme (ELSS) has been garnering a lot of appreciation nowadays owing to its varied features including its ability to save taxes under the section 80C of the Income Tax Act.

Aditya Birla Sun Life Tax Relief 96

The scheme has proven to offer magical returns to the investor. The main reason why this scheme is worth investing for is because of its superior performance. With a 10 year return, the fund has beaten both its niche category and the benchmark category.

The fund has performed better than its competitors over the last decade. Another reason why to invest in this fund is because this fund focuses more on quality and the fund managers have added only those funds which are able to sustain even under the pressure.

Axis Long Term Equity Fund

Axis Long Term Equity Fund was launched in 2009, but slowly and steadily it gained the pace. Now, the fund has performed a way better than its peers like DSP Rocks, IDFC and Invesco. Here are some reasons why you should invest in this scheme

- It is a diversified equity linked saving scheme that invests your hard earned money in large cap fund and selected midcap funds, which means the security is guaranteed.

- The fund has 3 years lock in period, which is the shortest among the other ELSS schemes.

- This scheme will help you in wealth creation and the tax benefit.

- It is an ideal scheme for long term goals like children education, retirement or any other long-term plan.

L&T Tax Advantage Fund

This scheme is meant for the long-term investors, who want to gain returns from the diversified portfolio. There are several reasons why you should invest in the scheme.

- The fund invests a majority of its amount in large cap profit making companies like HDFC Bank, Tata Consultancy Services, ICICI Bank, ITC, Future Lifestyle, etc.

- Though the fund has generated negative quarterly returns in the year 2018, but it is predicted that its annualized returns would outweigh the losses.

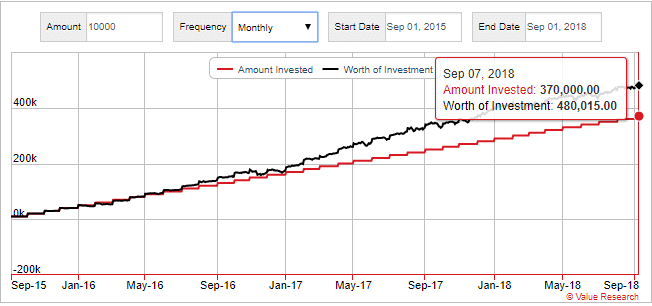

Motilal Oswal Long Term Equity Fund

It is one of the most focused (only 25 companies) equity linked saving scheme meant for the long-term capital growth. The fund was launched in 2015, but in 3 years the company has shown an excellent performance. The fund focuses on large and mid- cap companies to generate returns.

Here’s a snapshot of the returns generated by different schemes:-

| S.No | ELSS | NAV | % of returns generated | Date of launch of fund | |||

| 6 months | 1 year | 3 years | 5 years | ||||

| 1 | Aditya Birla Sun Life Tax Relief | 33.280 | 9.8% | 16.8% | 18.0% | 25% | 1996 |

| 2 | Axis Long Term Equity Fund- | 45.650 | 14.2% | 16.9% | 15.6% | 16.1% | Dec 2009 |

| 3 | L&T Tax Advantage Fund | 59.447 | 3.08% | 8.31% | 17.16% | 20.95% | Feb 2006 |

| 4 | Motilal Oswal Long Term Equity Fund | 18.96 | 3.1% | 4.6% | 20.1% | na | 2015 |