Today’s GST Council Meeting has given relief to SMEs and Exporters. This will definitely give BJP some relief as Gujarat elections are on the corner.

Quarterly Returns for SMEs with Turnover up to 1.5 crores

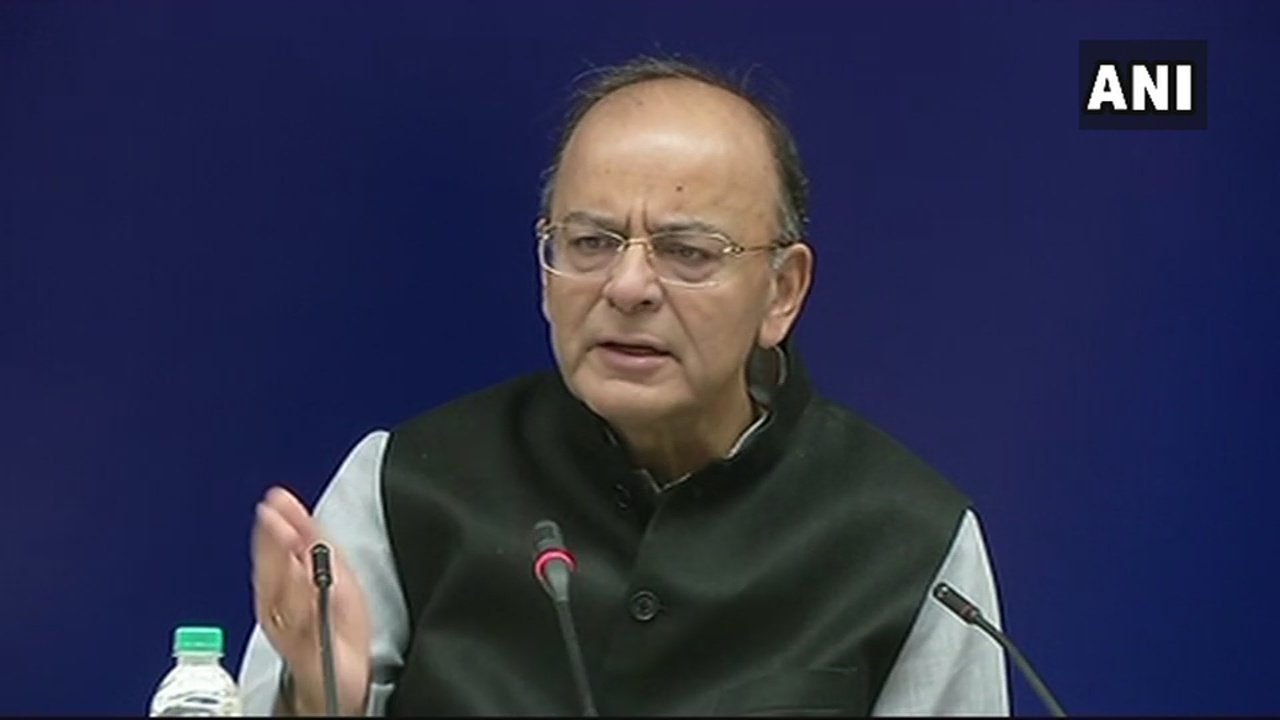

Arun Jaitely has confirmed that in the meeting it has been decided that SMEs with the total turnover of up to 1.5 crores will be allowed to file quarterly returns. Presently, only composition scheme holders are allowed to file quarterly returns.

As SMEs comprise most of the business in India, a relief to them will work in favor of the BJP as Gujarat Elections are on the corners. PM Modi, Amit Shah and FM Arun Jaitely yesterday had a meeting ahead of PM Modi’s visit to Gujarat on October 07 and 08. The aim is to give a sense of relief to already exasperated dealers and businessmen.

Increased Turnover Limit for Composition Scheme

Composition Scheme limit has been increased from 75 Lakhs to 1 Crore.

The Composition Window will be reopened for the traders to migrate or register to the composition scheme. In the previous meeting GST Council decided to re-open the window for composition option and government saw great excitement in retailers, manufacturers and restaurant holders about the composition scheme.

Relief to Exporters on IGST for Six Months, Rate Reduced on Few Items

It has also been known that exporters will get a relief for 6 months on IGST. Exporters have been down since the implementation of GST and the exporters have shown displeasure on tax refunds and higher compliance. Tax refunds on Exports will start from October 10 for July and from October 18 for August. Nominal rate of 0.1% on exports, says FM Jaitely so that the exporters do not face working capital issues.

This will help the exports and will give a sense of ease to the exporters. The council has also decided to develop an e-wallet gateway in six months.

Some Key Points from the GST Council Meeting

- Rates of GST on AC Restaurants will be reduced to 12% from 18% with no ITC has been discussed.

- Yarn, Clips and pins have been brought down to 5% tax slab

- Two decisions have been taken that requires amendment in the constitution, says Mauvin Godinho.

- Tax Reductions on many items have taken place in 28% tax slab.

GSTN will have a big challenge ahead to adapt the IT structure according to the frequent changes being done by the GST Council. The next GST council meeting will take place on November 9 and 10 in Guwahati.

Pingback: PAN Card Requirement Lifting For Gold: Boon for Blackmoney Hoarders?

Pingback: GST Council to Discuss GST on Real Estate, Would you Benefit?

Pingback: GSTR 3B Late Fees Penalty Waived off by Modi Govt for Aug and Sep

Pingback: GST Council Meeting Today: SMEs to Get Huge Relief

Pingback: GST On Export Of Services by Freelancers on Upwork, Fiverr