Bitcoin stabilized this week with a 6% increase in price hovering around $6,700 and most altcoins rose in global demand with a 10% to 50% increase in value. Ripple was the best performing Altcoin this week.

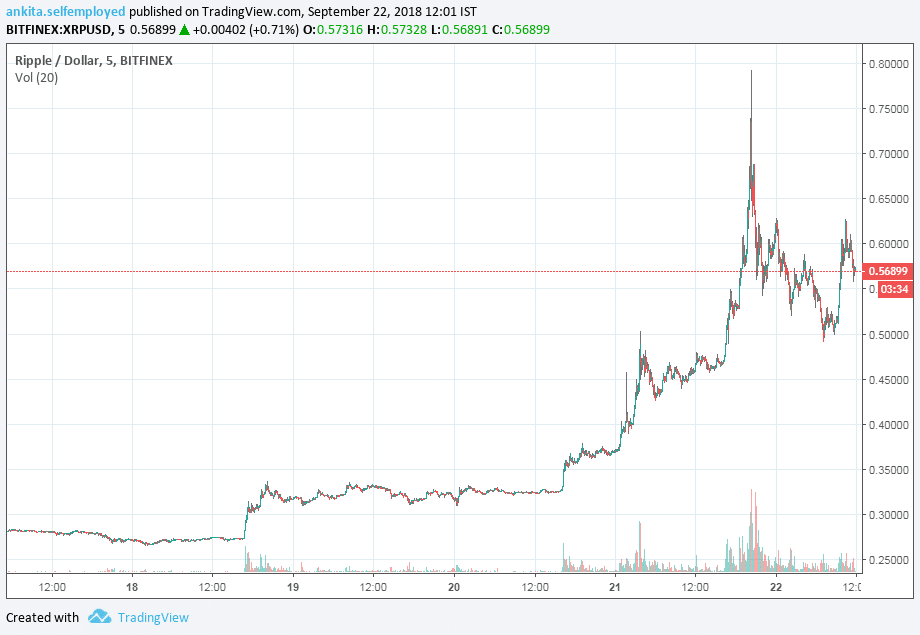

Ripple (XRP) ruled the cryptocurrency market during the last 2 days of the week. It rallied to $0.76 by Friday, up 192% from a fall of $0.26 at the opening of the week.

As the chart below shows, the altcoin is hovering in its range of $0.49 to $0.61. Falling rapidly during the last month it has seen a steady consolidation during the last 3 days. Many investors have sold out in the panic fall and few are still reeling in the visible saves.

With the bottoming out of the Bitcoin price at $6,000 levels, it is now expected that the periods of bears in the cryptocurrency market are coming to an end with a resistance level of $7,000 being tested. During the past 2 to 3 days itself, the capitalization of the cryptocurrency market has increased by $10 billion to $17 billion ,with bitcoin alone rising from $3.3 billion to $5.4 billion. With ethereum last week and Ripple this week, there has been a momentum of price rise throughout.

Bitcoin/Altcoins: Major News This Week

The Securities and Exchange Commission (SEC) has put a stop to the VanEck SolidX Bitcoin exchange-traded fund (ETF) once again. It is being said that the decision would be put on hold till March 2019, when the maximum time allotted will be lapse. SEC is doing so after ignoring 1,400 comments in favor of the ETF.

There is a major speculation on the volatile movement of altcoins since September 16, 2018 where major currencies lost more than 9% and slowly regained towards the end of the week. What would normally be a “block trade” in the equities market, a major holder of altcoins and bitcoins, possibly owned by one of the players of Silk Road scam who has amassed bitcoins in a high volume. A cautious and alert Reddit user claimed so by suggesting that the wallet was moving funds actively during the week with sub-divisions of 100 coins per wallet.

However, WizSec which is the famous Japan based security agency of (Mt. Gox scam fame) explained the movements related to a whale investor.

This year will be the when major banks took notice and created their functions for crypto-assets. From trading desks to custody of crypto- assets, since hedge funds and investment managers have invested in cryptocurrencies, these large banks have taken steps to incorporate these offerings in their services.