Bitcoin price rallied today above the $12,000 resistance. BTC to USD traded as high as $12,235 and it is currently correcting gains. Should u buy dips?

- Recently, there was a sharp rally in bitcoin price above $12,000.

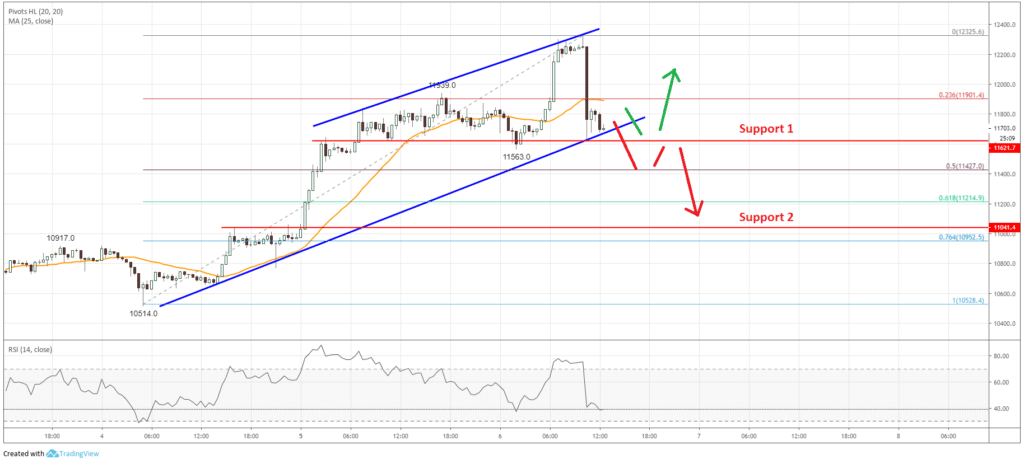

- BTC/USD is currently trading near an ascending channel with support near $11,650 on the 30-minute chart.

- The price could extend its decline below the $11,600 support in the near term.

Bitcoin Price Analysis (BTC to USD)

In the past three days, there was a strong rise in bitcoin price above the $11,200 resistance. BTC/USD did test the $11,600 resistance as discussed in the last analysis. Moreover, it rallied above the $12,000 resistance in the past three sessions.

Click to Enlarge Chart

Looking at the 30-minute chart of BTC/USD, the pair gained a strong momentum above $11,500 and the 25 simple moving average (30-minute). Finally, there was a break above the $12,000 and $12,250 resistance levels.

A swing high was formed near the $12,325 level before the price started a downside correction. There was a sharp dip below the $12,000 level plus the 23.6% Fib retracement level of the recent rally from the $10,514 low to $12,235 high.

At the moment, the price is trading above the $11,650 support. Moreover, there is an ascending channel forming with support near $11,650 on the same chart.

If there is a downside break below the channel support, the price could extend its decline below the $11,400 support. It might even break the 50% Fib retracement level of the recent rally from the $10,514 low to $12,235 high.

In the mentioned scenario, the price is likely to test the $11,200 or $11,000 support level. Conversely, if the price holds the $11,650 support, it could bounce back above the $11,800 and $12,000 resistance levels.

Overall, bitcoin price is correcting recent gains from $12,325 and it remains at a risk of a downside extension. If BTC/USD dips towards the $11,200 and $11,000 support, the bulls might consider it as a decent buying opportunity in the coming sessions.

The market data is provided by TradingView, Bitfinex.