The Bitcoin price has hit the troughs this year for a number of reasons. So far, it has struggled to maintain the $7,000 mark since April 2018. In view of the spate of bad news emanating from various governments, regulatory agencies, and market players, it is intriguing that Bitcoin is standing the test of time.

While some predicted a 90 percent value wipeout in price correction within a few months, this doomsday scenario is still far-fetched.

Will Bitcoin Price Become Numb to Bad News

Many people who provide uninformed opinion on Bitcoin reveal how little they know about the underlying drivers of cryptocurrency trade. Up to 2017, many critics passed off Bitcoin as a driver of the dark web. As more information got into the public space on how the Blockchain works, many critics have been astonished at the openness of the Bitcoin Blockchain.

One of the biggest pushbacks that hit Bitcoin among crypto believers the last 12 months was the surge of Bitcoin Cash. Many people felt that the loss of market share might be fatal for Bitcoin.

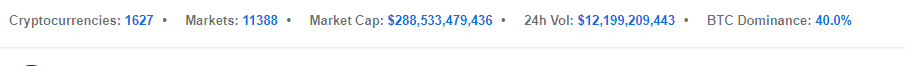

Some integration innovations like Lightning Network has shown that Bitcoin’s woes can be remedied. As we exit the second quarter of the year, the cryptocurrency market share of Bitcoin is hovering at 40 percent once more. See the market stats from Coinmarketcap below:

If Bitcoin price will witness a surge, it will be as a result of disregard of bad news. From reports of market manipulation by Tether to the hacking of crypto exchanges, there seems to be an invite to a season of numbness. The market will become numb to the onslaught of negativity that Bitcoin has faced in the last seven months.

It is my view that many investors who have sat on the fence till now will begin to take action from Q3 2018. In this light, a fresh surge of funds in the market is going to drive a Bitcoin price rally to year-end. There is likely to be a flow of institutional funds into the Bitcoin marketplace that is presently dominated by individual investors.

An Untapped Flow of Funds

There is a cache of funds across various financial markets globally. In Japan alone, it is reported that pension funds’ assets are valued at $1.2Trillion with the global count at $41 Trillion according To FT.

As a result of the regulated nature of pension’s assets, it is difficult to channel them into cryptocurrencies at present because of structural requirements. With the recent listing of cryptocurrency features at the CBOE, it is only a matter of time before institutional funds join the Bitcoin chase.

In recent months, the likes of Goldman Sachs, JP Morgan, and other big financial market players have begun to tinker with crypto vehicles. As the trade in cryptocurrencies deepens, institutional funds will up the price ante.

Looking Forward to a Fresh Bitcoin Price Surge

From the earlier pronouncement by the IMF that cryptocurrencies need regulation and not obstruction, there is a silver lining in the horizon.

Several western governments have voted for regulation of crypto trading, and this will spur more crypto investment vehicles in the short and medium term.

In view of the identified variables above, there is a place for popular optimism that Bitcoin price will hit the $20,000 mark and possibly beyond before the year ends.

Pingback: Ripple Price Forecast: Can XRP/USD Break This Resistance?

Pingback: Ripple Price Analysis: XRP/USD Entering 2017 Important Support Zone