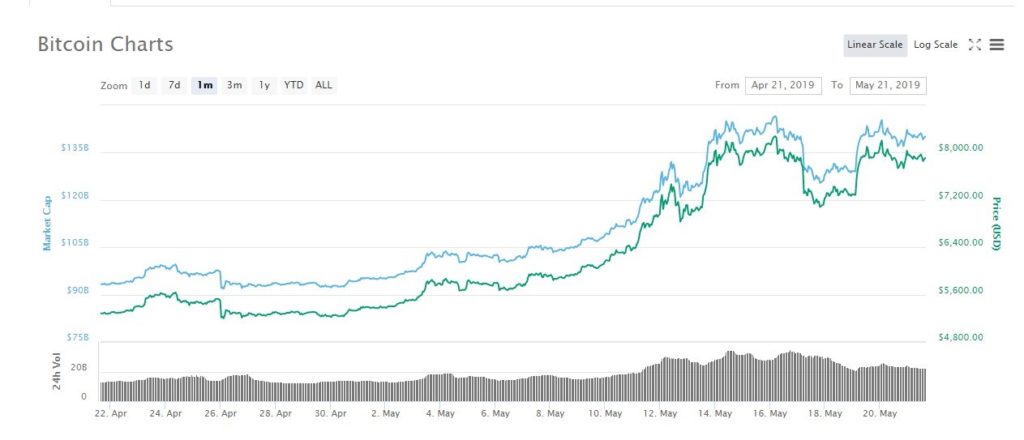

Bitcoin is in a new season of positivity with its market price staying above the $4,000 mark so far in Q2 2019. In the last one month, bitcoin value has hovered above the $5,000 mark, and comfortably surging beyond $8,000 on many occasions.

In the words, of JP Morgan, “this sense of bullishness currently dominating the cryptocurrency scene was last seen in the unforgettable price spring of 2019”

Why many analysts find it hard to pinpoint the underlying drivers of the new crypto spring, there seems to be a consensus that having survived the harsh winter of 2018, bitcoin now looks unstoppable.

The Headwinds

To recognize some favorable headwinds so far is expected in the cryptocurrency market scene. While the fate of fiat is no doubt tied to political and economic storms, bitcoin looks set to shine having survived acseries of conspiracies and bad press this past year.

Fear of a new Economic Crisis

When the stock market faltered in Q4 2018, many economists began to warn that a new economic crisis seems to be on the horizon. Although, the global markets seem to have shrugged off the pessimism, there are fears that world economy is not out of danger yet.

Innovative Ecosystem

Also worthy of note is that institutional players in global finance have done an about-turn since January 2019. JP Morgan has launched its stablecoins despite pooh-poohing the crypto idea this past year. Also, several innovations have emerged to advance the uses cases of cryptocurrencies.

The US-China Showdown

The showdown between the United States and China is another headwind that seem to favor the bitcoin spring. The effect of trade wars is predictable- tariff hikes, counter claims and revenge actions -which stymies productivity.

While there is no doubt that the US will have the upper hand in a full-fledged trade war, it is also certain that both economies will take a hit. On either side, market share will contract, some jobs will be lost, or furloughed, and a lower GDP growth rate will result.

The fallout of the above scenario is that the value of the USD and JPY will take a dip respectively. This definitely mean some loss of purchasing power and value erosion. This exactly favors cryptocurrencies and bitcoin to be factual. In a bid to avoid loss of value, you can expect that more fiat will be converted to crypto, implying increase in demand and market price.

Making The Call

With the market scenario promising higher prices for cryptocurrency, there might be no need to ask a fortune teller what the price of bitcoin will be in weeks and months from today. Some expect Bitcoin Price to retest $12,000, and others see it going higher than that. From all indications, bitcoin seems to be in for better days, and for optimistic traders, this might just be the best time to buy and hodl.