Bitcoin transaction fees denominated in US Dollars have recently declined by 95%. The transaction fees and speeding the bitcoin transactions are two main important features for trading the Bitcoin.

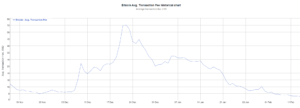

Bitcoin Transaction Fees Decline

Source Bitinfo

Above chart shows how the Bitcoin transaction was lower than $2 per transaction when the Bitcoin price was less than $2000 and then the transaction cost moved up to more than $60 per transaction when the price of the Bitcoin moved to the level of $22,000 within the span of few months. This shows the direct correlation between the Bitcoin price and the transaction fee.

Bitcoin Demand & Supply

At the end of September 207, the average bitcoin transaction fee was around $2 per transaction. By December 21st, the average fees reached a high of around $37. The increase was due to the supply and demand. As BTC/USD surged from $10,000 to $20,000, lot of investors wanted to invest in the cryptocurrency, which increased the demand for miners’ services. However, the supply is constrained. As per the blockchain system, the cryptocurrency can process only 3 to 7 transactions per second. Therefore, now a greater number of transactions were competing for a relatively small number of slots in the ledger.

Further, the mining fees is optional and bitcoin users do not need to pay them. However, they are paying. The fees encourage the miners to record their transactions sooner rather than later. Generally the higher mining fee for the sooner you want a transaction written to the blockchain and complete the deal.

The speeding of recording the bitcoin transactions is important in a volatile market where the price of bitcoin is fluctuating by hundreds or even thousands of dollars in mere hours or minutes. There is a big advantage to buy and sell coins sooner rather than later and many bitcoin investors are paying up for just that advantage.

There is also network costs which fluctuate based on how busy the network is. These charges are not optional and BitPay charges them on all transactions to record those transactions as quickly as possible.

Currently, the number of transactions added per second have fallen by approximately 50 percent from the December highs. The fall in the price of bitcoin recently has led to fall in transaction fees that are in U.S. dollar.

Additionally, there are extra blocks mined per day available now compared to December 2017. The increased supply of block space by way of more blocks mined on a daily basis and number of efficiency improvements enabled in terms of how the blockchain is used by those who wish to create transactions, which had led to ultimate fall in the transaction fees.

Bitcoin Lightning Network Will Help?

Since Bitcoin transaction fee and the slow transaction times have become a problem for Bitcoin. “Lightning Network”, which we referred in our previous article, will solve the problem. This is a technological implementation that, later this year can put an end to the problem. The Lightning Network would allow the users to send multiple transactions to and from outside of the blockchain. This would operate as a second layer on top of the existing distributed ledger network that underpins the digital currency.