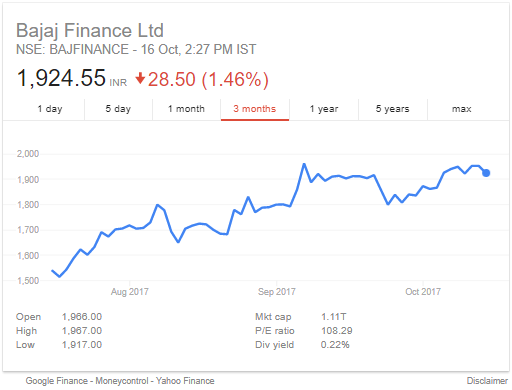

Bajaj Finance is the best bet for investors presently as its market is doing pretty well. Since July, it witnessed a 32% profit that makes it favorable for investment.

Favorable Market and Positive Fundamentals

Bajaj Finance is doing extremely well with a share price of Rs. 19424 (BSE 2.27 pm today) which is extremely good given the situation. In last three month, the share price of Bajaj Finance has seen a tremendous price growth of more than 30%. On July 13, the market price of Bajaj Finance was 1483.40 which have now increased to 1945. An investment in this stock will yield positive results with respect to other investments.

This growth is supported by strong fundamentals and growth in business. Q1 FY2017 has been fantastic for the firm; earnings might continue to exceed market expectations in Q2 reports as well. With festive season buying and increasing demand of working capital post GST is a good sign for finance companies to grow their lending portfolio.

Looking at the historical chart, the shares got split with a ratio of 1:5 on 08th September 2016 and Bonus of 1:1. Since then the price has almost doubled within 1 year’s time.

Should you invest?

The market looks perfect for investment. The sale is on the rise and as Diwali is coming, it can be expected that the sale will rise. The stocks are also expected to go up. The low NPAs are also making the non-banking Bajaj finance a favor destination for investment.

Motilal Oswal issued a research report which says that the company has the potential to sustain its 30% + AUM growth over recent future and the level of 2300 in 1 year.

Many other experts too have favored investing in Bajaj Finance given the growth it has.

Disclaimer: This is author’s personal opinion. Do verify with certified experts before investing.