Cobalt price per ton has hit the 59,499 mark as at morning trades of 12th October 2017 and in a threshold track over six weeks, it has maintained a stable momentum. The demand for the precious metal is increasing in the wake of disruptions from Congo, which accounts for 45 percent of world supplies.

Cobalt as key input

Cobalt is a key input in the production processes of batteries in the cell phone and electric cars. The input comes in as a vital component in lithium-ion batteries, which finds relevance in a number of digital appliances. Beyond the powered batteries in electric cars and cell phones, they also find a place in, self-balancing scooters, laptops and several other items.

The growing digital wave blowing across the globe creates more room for the value of cobalt to soar in the marketplace and there is no let down on this phenomenon. Since the natural occurrence of the precious metal is not one that can be easily replicated, any supply-side event will impact on the market price.

Violence in Congo

The violence in Congo has spanned the better part of the last decade and has flared up in recent days. The instability in the region reduces the quantum of the precious metal that can be mined and shipped abroad from the conflict spots.

While world focus has shifted in recent times to source for alternative sources of the precious metal, the results are surely going to be slow in coming. New mines have to be surveyed, fitted with the requisite equipment and delineated for mining activities. The processes involved cannot be completed overnight, and this is one reason for the soaring price of cobalt right now.

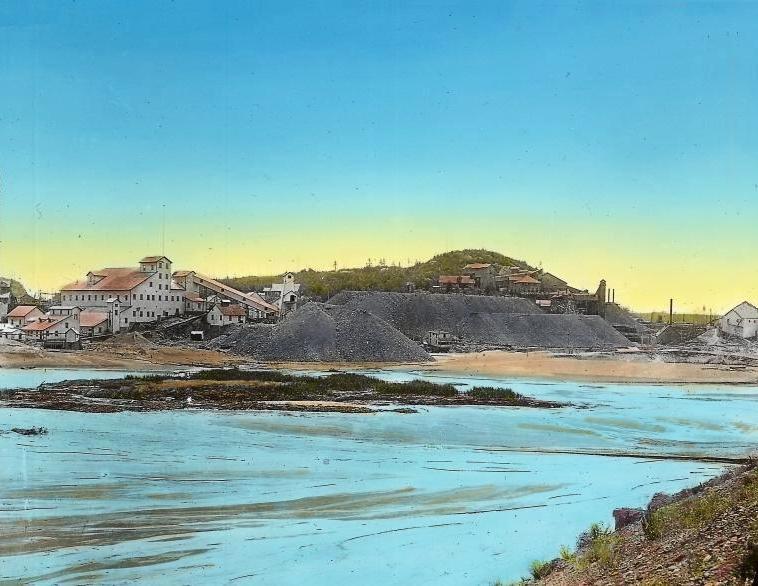

The Canadian alternative

Mining companies have turned to Canada to boost their cobalt output, as the country has proven reserves in huge quantity in the region of Saskatchewan. The companies are looking to grow their output here and elsewhere in Europe to make up for the supply lag created by the Congo conflict.

The impact of stringent regulations in western countries is a disincentive that makes companies turn to the less-developed regions of the globe for precious metals. There is no doubt that stringent regulations lead to higher costs and lesser profits for the operating companies.

Investor opportunities

Opportunities are abundant right now for investors looking to make better returns on investment as they pick profitable stocks. Mining companies involved in cobalt production are sure to make a better turn at year-end when their results are published.

Increasing demand, stable market and assured returns on investment are a huge plus for cobalt stocks at the moment.