Morning trades for October 31, 2017, shows crude oil price hovering around the $60 mark. Many market watchers are left wondering if the crude oil price Bull Run is here to stay.

The oil cartel OPEC has been urging allies like Russia to agree to the subsisting output cut till 2018 and this is a clue to the surging prices.

OPEC is expected to hold its next on November 30th at the Cartel’s headquarters in the Alpine city of Vienna, in the Northeastern fringe of Austria.

Crude Oil Price Forecast: Beating the $60 Mark

The early concerns during the first quarter of the year were centered on the oil glut and OPEC members shuddered at the impact on their respective economies.

The resolve of the cartel to drain the oversupply led to quota reductions among member states and other oil producers like Russia. Against market cynicism that the resolution might not last, the production caps have endured till this time of the year.

For the first time since the last price highs of 2015 that saw the upper limit of $60, the price of the commodity has hit that mark again this week.

The Saudi Arabia Push

Saudi Arabia boasts of the largest single oil reserves on earth among the comity of nations according to OPEC. The country’s Crown Prince Bin Salman voiced his support for the extension of the supply cuts till 2018 after Russian leader, Vladimir Putin asserted that he was supporting keeping the lids on.

This clear position by two major oil players is certainly a factor to look at when considering if the crude oil price Bull Run is here to stay. The Saudi Arabia push, Russian support, and OPEC resolve seem to support the surging price outlook at least till sometime in 2018.

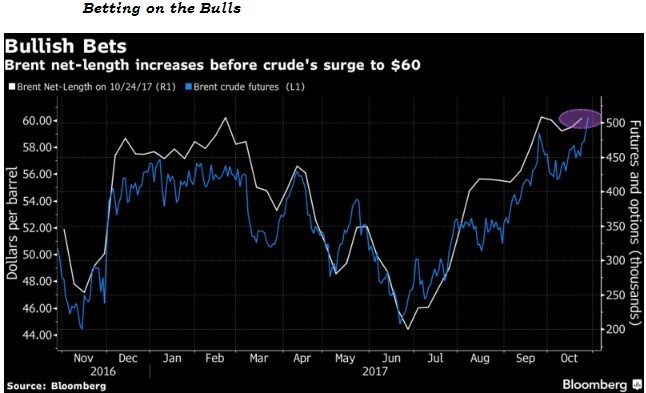

Betting on a Bull Run

As the inventories of American producers hit the lowest point over the last 18 months, oil traders feel that the fundamentals are strong for a crude oil price bull run. Other market players are agreeing that the demand for oil is not driven by Chinese orders only as the current price run shows.

Hedge fund strategists have taken a long position on the sweet Brent variant of crude oil that shows that 1.5 % increase by holders. Shorts, on the other hand, have slid by a record 6.6 % since the last low in Q1 2017. Market profiteers have lined up to make a kill from the present Bull Run and I see this continuing till the next suppliers’ quota review in 2018.

Do not forget that other uncertainties as well as non-market related events like the North Korean and Iranian belligerency will fuel the price surge, at least over the next 12 months.

Pingback: Saudi Crisis Impact on Global Markets and Oil Price

Pingback: Crude Oil Price Uptrend Intact Above $68.00