In a week’s time, the whole cryptocurrency market has fallen to approximately $252 billion, which is a fall of over $100 billion over the past week. The price of most major cryptocurrencies including bitcoin, Ethereum, Ripple, and Bitcoin Cash have plunged by more than 12 percent in two days.

In addition, tightening of regulation and policy ambiguity have made the cryptocurrency weak from the few months, though industry experts expects this phase to be temporary.

Bitcoin has fallen from a level of $7,900 to $6,600 within 24 hours, but recovered slightly with strong resistance at the $6,600 level. As per Fundstrat’s Tom Lee, Bitcoin can come to a level of $20,000 by the year end, even if the recovery in the market starts in midterm. Among the top 10 cryptocurrencies, EOS and Litecoin (LTC) are the two in green today!

Institutional Investors in Cryptocurrency Market

As per Bill Barhydt , the demand towards the cryptocurrency market is not coming from the institutional investors and retailer traders in the west like Japan. However from Asia the institutional investors are participating.

Therefore, once the investments from the institutional investors from the west starts coming in, the cryptocurrency market market will recover.

Further, as per Barhydt, the hedge funds, institutional investors, and investment firms are constantly having a watch on the cryptocurrency market, and looking for ways to enter this market. He told that large hedge funds will enter the cryptocurrency market after the market stabilizes and extreme volatility of bitcoin and other major digital currencies reduces.

Cryptocurrency Trading Volume

Cryptocurrency market is witnessing low volume, for which the market is falling. Therefore, cryptocurrency may continue to fall for the next few days due to the weakness in the market volume. Further, if Bitcoin fails to maintain its volume, it could fall below the $6,000 level and can lead the market to another bear cycle.

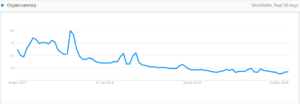

Earlier, we flagged concern on decreasing google search trend towards cryptocurrency world and it continues to be a caution.

Uncertainty Over Regulation

Only Japan has clarified its position on cryptocurrencies, and no other countries including India has taken stand on it. There is a fear among the investors or the traders due to the uncertainty of regulation. In India, cryptocurrencies such as bitcoin and its competitors are neither legal nor illegal, bust since the government and Reserve Bank of India have cautioned investors to be away from these cryptocurrencies.

At G-20 the regulators and policymakers have warned of the increased risks related to investor protection, market integrity, tax evasion, money laundering and terrorist financing. In the upcoming summit, Crypto regulation will definitely be a priority in connection with the risks on agenda.

The email servicing firm MailChimp has banned the users, who are involved in the production, exchange, storage, sale or marketing of cryptocurrencies, but the information about it can still be sent across.

Overall, currently there is a negative wave flowing against the cryptocurrencies market. Otherwise, it can recover after the fear among the investors subsides.