Anyone who has taken a position on EUR/USD trading must be a watcher of the economic data and related developing news that can make or mar expected returns.

To identify where EUR/USD trade is headed might there is a need to evaluate how much pressure policy news impact on exchange rate movement.

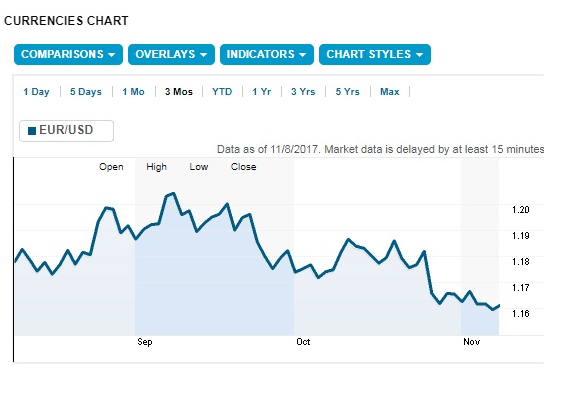

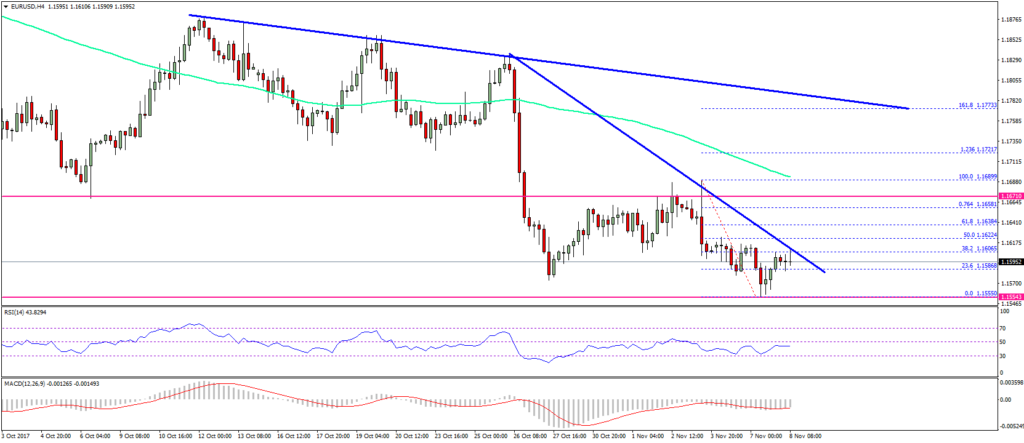

Over the last 24 hours, the EUR/USD pair has been moving between 1.1603 and the 1.1614 mark

Euro to Dollar Standpoint

Traders and other speculators have in recent weeks adopted a broad spread in EUR/USD pair, and this is best viewed as a headwind for the shared currency. The long position taken for the EUR surged towards the upper limit in the most recent weeks.

Eagle-eyed traders have taken note of a possible turning point in the weeks ahead that might shrug off the bullish run that has dominated Q3 2017. While a major reversal might not be envisaged, a sprinkling of ultra-market events like the Catalonia brouhaha is a dampener.

Is price correction expected? Yes. This should be envisaged over the last few weeks left in the year, and do not doubt the propensity of the market to self-correct.

EUR/USD Current Trading Numbers

As at Friday, EUR/USD tottered on the lower end of $1.1606 threshold with indications pointing at more of possible lows on the short term. More traders looked at the 1.1596 mark to the USD and they are cynical that this could drop to 1.120 if current trends subsist.

If the European Central Bank draws back on quantitative easing, the EUR/USD map might look ominous, but, if Draghi and his cohorts decide otherwise, then you can expect a steadying of the EURO.

As at late trades in NY yesterday, 1910 contracts were added by futures traders as the rate of EUR/USD remained below 1.1625.

Outlook For EUR /USD

The surge of the USD can be traced to the booming equities as data emerged to show that Q3 earnings got rosy for the US corporate. On the flip side risk takers from the German end lost their appetite and the market noticed this sharply.

It is not out of place to expect that EUR should be best held on a short for the course of the year except major unplanned scenarios unfolds. The expected rosy end in Q4 for US corporate is an indicator that you should place your EUR/USD on a short leash and play safe.

Never forget that the investment market is largely impacted by unforeseen events and market data can go south against all odds. So, trade with this fact in mind!