HDFC Bank, SBI, PNB increased FD interest rates to boost investments and money flow after the recent interest rate hike by the RBI monetary policy review committee.

Ahead of RBI’s bi-monthly monetary policy review, the country’s largest lender bank SBI announced a spike in its fixed deposit rate signaling a positive sentiment for the traditional investor.

There was a time when the traditional mode of investment like FD’s ruled the roost and seniors cautioned us to invest money in the share market, but with the passage of time the FD’s became an obsolete mode of investment, but now it seems the government is again pushing the investors towards it.

Revise FD Interest Rates

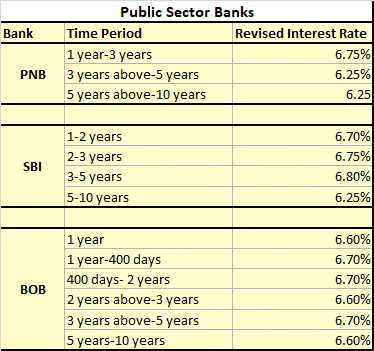

SBI has raised interest rates by 5 to 10 basis points and these rates will be effective from July 30. Here are the details for the same

For 1-2 years FDs the interest rate will rise to 6.7%, for those FD’s that’s maturing between 2 years and 3 years the rate has been increased to 6.75% from 6.65%, those maturing from 3-5 years will now earn interest rate upto 6.8% and 5-10 years FD will fetch an interest rate of 6.85%. Earlier SBI has increased its deposit rate in May where it had hiked in between 5 points and 25 points for the select tenure for fixed deposits below 1 crore. The latest hike by the bank indicates upward pressure on the interest rates by the banks.

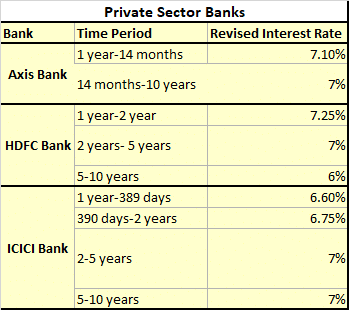

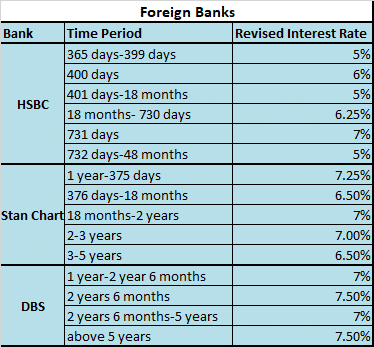

Following the suit, there were others banks like HDFC, PNB also raised the FD interest rate. Here’s a detailed comparison interest chart of different banks.

What to look before investing?

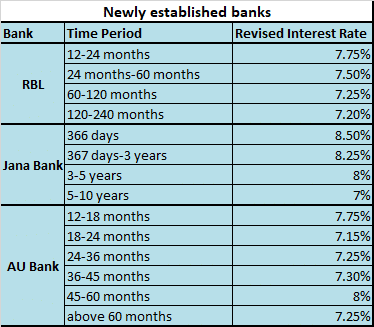

Finally, the depositors can smile a bit. But before investing the amount in the bank don’t look only at the interest rates offered, there are various things that you need to consider other than the rate of interest like whether the banks are the new ones or traditional ones, the tenure period of FD and premature withdrawal penalty levied by the bank.

For example, SBI levies 0.50 percent withdrawal penalty for deposits upto 5 lakhs below 1 crore and above Rs 5 lakhs but below 1 crore the penalty levied is 1 percent.

There are various small corporation banks like Jana Small Finance Bank that doesn’t levy the withdrawal penalty on the Fds, taxes, etc. In the end, we would like to conclude that as the current interest rates for short and medium term have gone up, it is advisable to continue with this traditional mode of investment.

Pingback: Aadhar Housing Finance NCD Offer Better Than Bank FD?