The decline in gold price makes us think has its sheen gone away? Should the investor invest in it? What is the reason behind its muted demand from the local jewelers and retailers even as the yellow metal has shown some strength overseas? Well, in this blog post, we will discover and explore the reasons behind its tepid demand and will it rise from strength-to-strength.

The numbers say it all…

Today, the gold fell by Rs 70 to Rs 29,580 gram. Silver also declined by Rs 100 to Rs 37,800 per kg due to its reduced demand by the industrial units and coin makers. MCX Gold futures were trading at 0.19 percent or Rs 53 down at Rs 28,480. Here’s a table showing that:

Globally speaking, the gold has plummeted down by 0.45 percent to $1,257.10 ounce and silver by 0.31 percent to $15.87 an ounce. In Delhi, the 99.9 percent and 99.5 per cent purity of gold has fallen down to Rs 100 each to Rs 29,950 and Rs 29,800 per 10 grams. The precious has lost its shine.

What’s the reason behind Gold Price decline?

The reason behind its current decline is- rising geopolitical and economic uncertainties. The tightening of monetary policy by Fed is another reason behind it. The policy makers of Federal Open Market Committee is expected to raise the rates at the meeting to be held on December 12, 13, which would be the third hike in a row, further curbing the appeal for yellow metal. The war like situation between USA and Korea is also contributing towards its lackluster.

Other reasons cited behind the decline of gold price are the rise of alternative assets like bitcoin, and equities. The cryptocurrency has been widely welcomed by the new investors and traditional investors alike.

Should the investors invest in Gold Now?

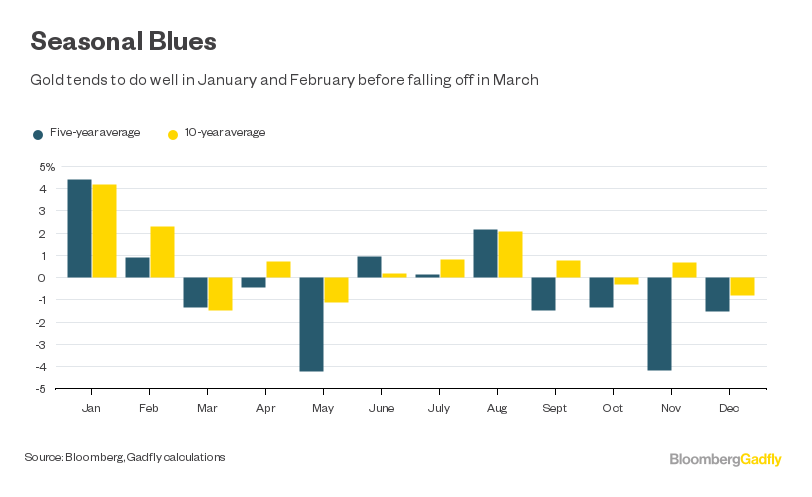

Despite being weak since May last week, it is predicted that the gold could be in stronger than now. These are the seasonal blues that will fade away with time.

With New Year and Christmas around the corner, the demand will soon surge up.

Pingback: Crude and Gold Prices Surge with Weakening US Dollar