With the likes of Upwork, Fiverr, Freelancer and other platforms, sourcing of work has become easier for freelancers in India and around the world. Amidst all the confusion regarding GST, freelancers in India are puzzled about the GST impact on export of services through these platforms. Lets try to understand.

What is GST on Export of Services in India?

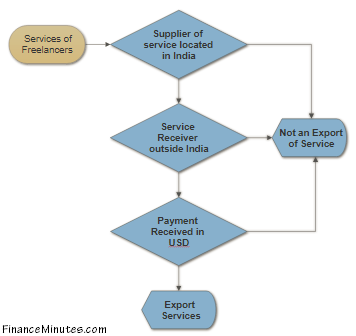

Export of service is defined as supply of any service when:

- The supplier of service is located in India

- The recipient of service is located outside India

- The place of supply of service is outside India

- The payment received against such service is in convertible foreign exchange

- Both the supplier and recipient are not merely establishments of a distinct person

All the freelancing services via any platform such as Upwork, Freelancer, Fiverr etc. meeting above conditions qualify to be Export of services. The only question which had been raised by the service tax department from time to time is “place of supply” since the services are supplied online.

We can conclude that freelancing services to clients outside India meeting above requirements qualify as export of services.

Taxability of Export of Services under GST

Under GST, Export of services is considered as an inter-state supply therefore GST is applicable on all such transactions irrespective of any threshold.

In order to promote exports, the government has fixed zero rate of GST on export of services but all compliances to be done as per the law.

Freelancer on Upwork/Fiverr? Should you register under GST?

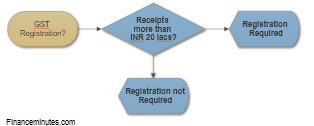

The threshold limit of Rs. 20 lakhs was only applicable to intra-state supplies but in recent GST council meeting held in October, GST Council relaxed the limit for inter-state supplies as well.

This gave a big sigh of relief for small freelancers having receipts less than Rs. 20 lacs in current financial year.

Therefore, freelancers earning receipts of more than Rs. 20 lacs has to register under the GST.

Benefits under GST For Freelancers in India

If you are registered under GST, you will have to file monthly summary return with details of work done on these platforms.

An additional benefit would be the refund of credit on input services. This will reduce the burden of wifi bills, mobile bills, cost of laptops and other equipments. As a registered GST dealer you just need to quote your GST number on any purchase or expense you incur. You can then claim this GST paid as a refund from the GST department against export of services.

Although the compliance burden might increase on export of services under GST but you have additional benefits of input GST credit to compensate your costs.