GSTR 3B was introduced by the government in order to provide ease in filing return. GSTR 3B should be filed before 20th August for July and 20th September for August of 2017. This form is only for two months.

An Overview of GSTR 3B

GSTR-3B is a return form to be filled by regular registered businesses for the month of July and August. It was introduced to ease the businesses from filling lengthy forms like GSTR-1 and GSTR-2A. GSTR-3B is easy to file by mentioning the sales, total earning, tax applicable and filing return. Here is a detailed explanation for the process of filling the form.

How to File GSTR-3B?

If you are registered on GST portal then, login into your account by entering the username and password. Click on Returns dashboard and chose financial year 2017-18 followed by July as month if you are filling your return for the month of July. As you will click on the search button, you will have to select the form you want to file. Select GSTR-3B option and you will enter the main page where you will have to fill the details.

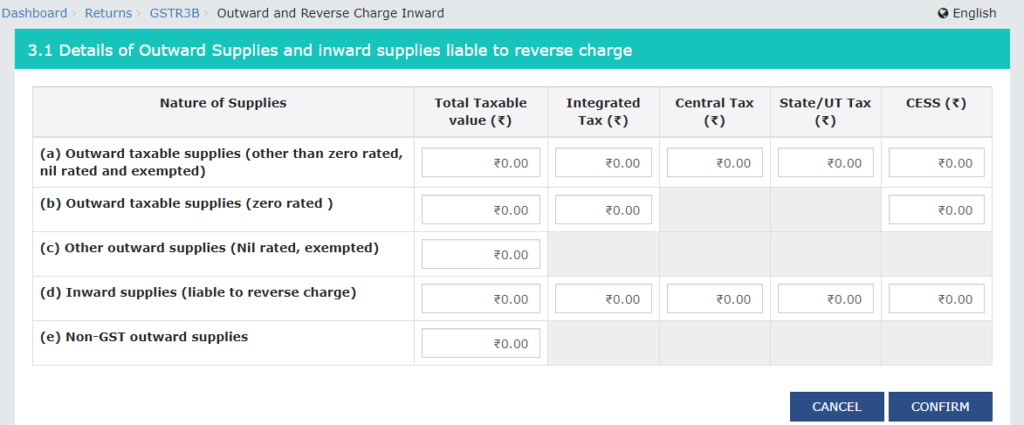

Outward supplies and reverse charge

There are seven parts into the form starting from 3.1 and ending to 7 (3.1, 3.2, 4, 5, 5.1, 6, and 7). The first part that is 3.1 is for Details of Outwards supplies and Inward Supplies liable to reverse charge. In this, there are five columns depicting nature of supplies and five rows depicting nature of taxes levied. You need to fill all of them by first mentioning the total tax, SGST, CGST, IGST and cess if applicable. Confirm and then move out after filling the numbers.

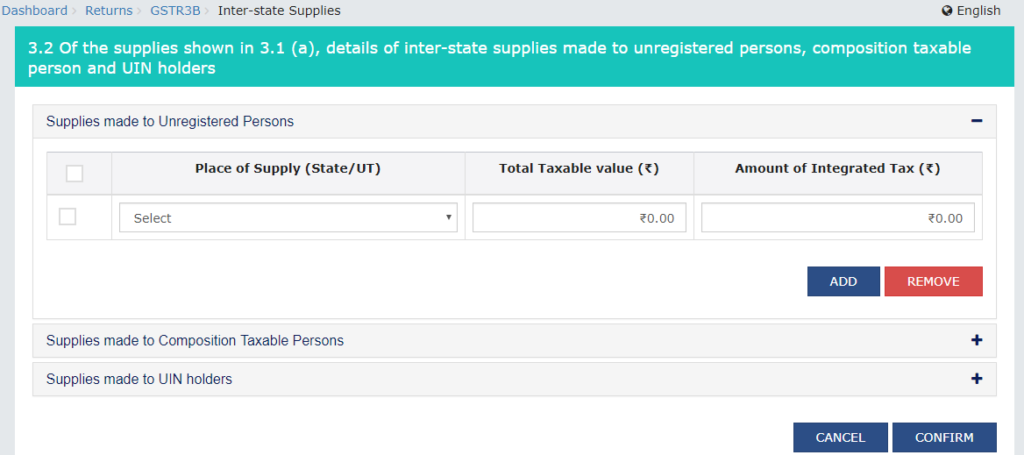

The 3.2 part is about mentioning the people you have supplied your goods interstate. There are three categories in this. The first is unregistered person to whom the supply is made. The second is Composition Tax payer while the third is UIN holder. In all of the three you need to mention the state to which the good is supplied and the total tax + integrated tax. Confirm and proceed.

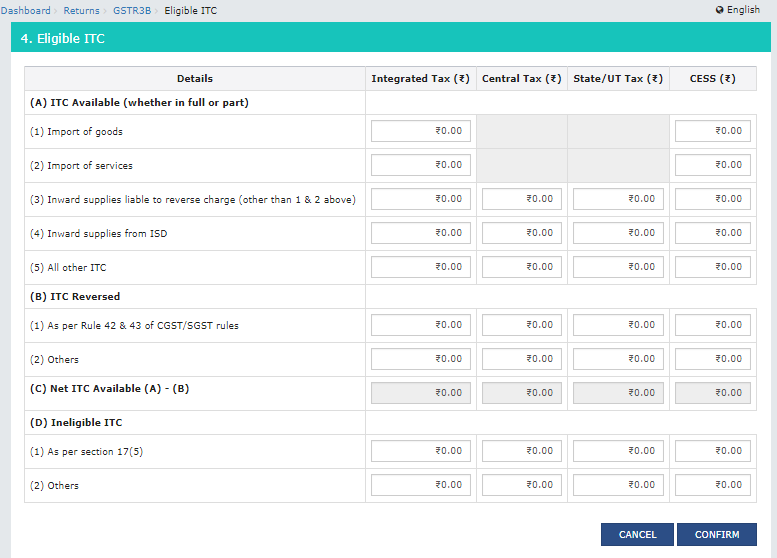

Input Credit

The 4 part is about filling Input Tax Credit or ITC. The form is divided into four parts name A, B, C and D. A is about ITC available including import of goods and services. B is about ITC reversed while C is about Net ITC Available (A-B). D is ineligible ITC. In all of the four you need to fill the 5 types of taxes including the cess and then confirm.

GST Payment Details

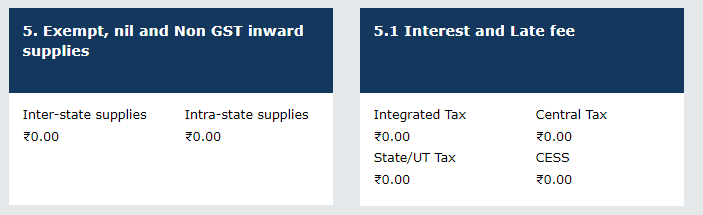

In the 5 Part, you need to fill about the goods that have NIL or exempted tax for both inter and intra state. The 5.1 part is about filling interest rates and late fees, if any. After this you need to acknowledge the terms of submission and submit your return. This will activate the part 6 for paying total tax levied in the form of SGST, CGST, IGST and cess. Net GST payable as per the return has to be paid using create challan function. Once the payment is made, you can set off the GST outward + reverse charge liability with input credit and payments.

The last or 7th part is for TDS/TCS filling. TCS is for E-commerce industry and is applicable when a vendor sells his/her product through that particular portal.

Dos and Notes

After you fill all the details, save the form followed by submitting it. Both of these options are given at the bottom. Next you need to confirm on the declaration statement and then file the GSTR-3B form either with DSC or with EVC. It depends on the options you have chosen at the time of registration. Filling with EVC is the easiest of all. In this, you need to file the return by clicking at the option and then you need to enter the OTP sent to your registered mobile number. After confirming the OTP, your return will be successfully filed.

NOTE: When filling for a NIL return that is when the sale is zero of that particular month, you just need to scroll down and save the form followed by submit and filling option as the tax applicable will be zero. Composition scheme holders don’t need to file any GSTR-3B return.

We hope that you are now clear on how to file GSTR-3B and you will do it before the deadline.

Pingback: GST Composition Scheme Reopens untill 30th Sep, Should you Opt?