ICICI Bank and Bank of Baroda has declared their Q1 results for FY2018-19. Now, Its time for the Investors to decide where to place their bet among the two leading public and private sector banking stocks.

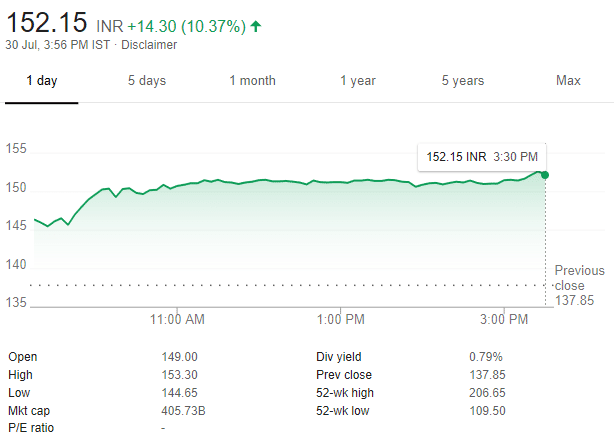

Bank of Baroda for the first quarter has delivered a profit of 5.28 billion rupees beating the earnings estimates of 747.2 million rupees. The profit has more than delivered as the bank had reported net profit of 2.03 billion rupees in the corresponding quarter last year. As a result, BOB stock rallied about 10.27% at 152.15.

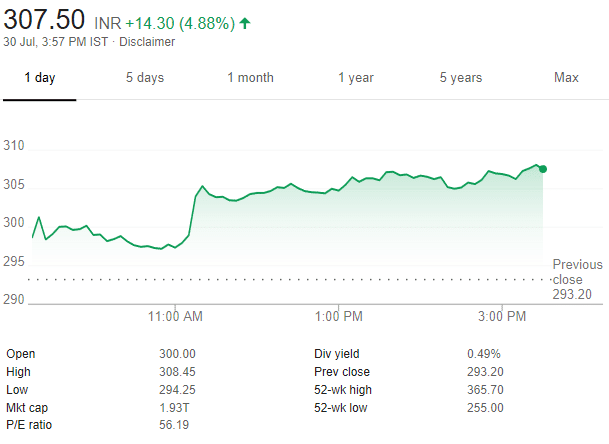

On the other hand, the largest private bank, ICICI Bank has reported the first quarterly loss of Rs 119.55 crorein its first quarter missing the analyst estimates of net profit of Rs 1,306 crore for the first quarter. The bank had reported a profit of Rs 2,049 crore in the same quarter last year.

BoB’s profit in the first quarter rose due to fall of provisions for bad loans, which fell 18.4 percent to 17.60 billion rupees. Further, the bank reported strong loan growth, lower credit cost and recoveries made from Bhushan Steel.

Meanwhile, ICICI bank in the first quarter 2019 has posted loss due to the bank has set aside more money to cover for bad loans in order to comply with with the Reserve Bank of India (RBI) guidelines on old nonperforming assets (NPAs). However, the brokerages are still bullish on ICICI bank stock as the gross additions to NPA were the lowest in 11 quarters, which reflects an improvement in asset quality. As a result, ICICI bank rose 4.88%

Non Performing Assets

ICICI Bank for 1Q FY 19, has reported the 3bps fall in the gross non-performing assets to 8.81% and net NPA in the quarter came fell by 58 bps to 4.19%. However, Bank of Baroda’s gross NPAs rose to Rs 55,875 crore in the first quarter compared to 46,172 crore in the year-ago quarter. Net NPA also rose to Rs 22,384 crore from Rs 19,519 crore at the end of the year-ago quarter.

Chart of BOB

Chart of ICICI Bank

U.S. economic initiatives in ‘Indo-Pacific’

U.S. Secretary of State Mike Pompeo is expected to announce a series of investment initiatives in Asia, that will focus on digital economy, energy and infrastructure. This is a part of President Donald Trump’s “Indo-Pacific” strategy. The strategy has been made to rebalance China as China has grown and has become a strategic competitor of US.

Moreover, the strategy lacks institutional implementation. “Indo-Pacific” strategy requires the investment of approximately $26 trillion in order to fulfill its potential. India is expected to attend this forum along with officials from Japan, Australia, Singapore and Indonesia. This event may also give some boost to the stock market’s positive direction.

ICICI Bank has projected a further improvement in Provision Coverage to 70% compared to current 54%, which will keep overall credit costs at higher levels at least for FY19. Since the asset quality of the bank is improving, there is an expectation that the earnings will also improve. The target price on the ICICI Bank stock is Rs. 375, with a “Buy” rating for a time period of one year. Moreover, due to turnaround result of Bank of Baroda in the first quarter, the target price on the stock is Rs. 180, with a “Buy” rating for a time period of one year