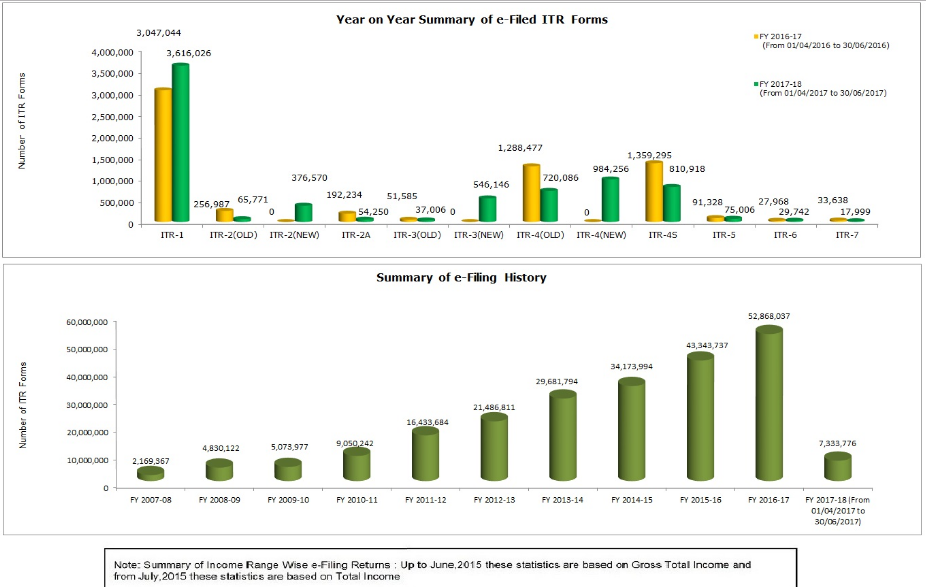

Income tax is an important source of revenue for Governments. Historically, India has received low-income tax revenue. Latest reports from the Income Tax Department has revealed that the number of returns filed for 2016-17 has grown at 24.7 % as compared to 9.9% in the previous year.

An additional 2.82 crore individuals have filed their income tax return for 2016-17 leading to an overall increase of 25.3 per cent.

The fruit of Demonetization.

One of the criteria that the Chief Economic Advisor Arvind Subramanian identified to determine the success of demonetization was increased tax compliance. He also mentioned that number of tax payers need to go up. The latest figures from the IT department prove that the same has been successful. The Government of India has also attributed this increase to the success of demonetization and operation clean money.

Indeed this will prove to be an encouragement for the Government in its action against Black money.

What next for Government

Improved rates of tax compliance and revenue to will empower the government to undertake further investments which will trigger economic growth in the nation. Increased investment in the much-needed infrastructure sector by the Government will also assist India to maintain if not increase its strong growth rate.

PAN deactivation – another attack on tax evader.

In line with its aim to eradicate black money and combat tax evasion, the Government launched a drive to identify and deactivate multiple PAN identities. Permanent Account Number (PAN) is a code that acts as an identification for India National to file Income Tax returns. It is to evade taxes that individuals hold multiples PAN cards under fake identities. The Government has announced that those found guilty of having multiple PAN will be penalized an amount of Rs. 10,000 under section 272B of the Income-tax Act, 1961.

At present 11 lakh PANs have been deactivated by the Government. To verify whether your PAN No is still valid, you need to visit Income Tax e-filling website. On the website, a special link has been provided for the verification process. You will have to fill the required details and enter the OTP which will be sent to your registered mobile number. Upon completion of the process, you will be able to see the validity of your PAN number.

Pingback: Income Tax Rate Cut or GST on Petrol and Diesel: Which is Better for Govt