Oil imports from United States is proving out to be cheaper than imports from UAE. A significant deal with US opens alternatives for India’s oil requirements.

Indo-US Oil Imports Cheaper than UAE Oil Trade

India received its first shipment of US crude oil on Monday at Paradip port. This process started after Indian Prime Minister Narendra Modi and US President Donald Trump agreed to strengthen ties in energy sector in June 2017. Indian Oil and Bharat Petroleum have placed an order of over 2 million barrels of oil from the US.

The first US crude oil cargo of 1.6 million barrels bought by Indian Oil Corporation from the US has been received at Paradip port today. pic.twitter.com/NEzL6rtgJd

— Indian Oil Corp Ltd (@IndianOilcl) October 2, 2017

The oil per barrel from US will be cheaper by $2 in comparison with UAE of oil rate per barrel. India imports most of its oil from UAE. Indian Oil became the first company by importing US oil after placing an order for 3.9 million barrels. BPCL has placed an order of 2.95 million barrels for its Kochi refinery while Bharat Petroleum has placed an order of 1 million barrels of US oil for its Vizag refinery.

Reliance Industries Limited, the owner of world’s biggest refinery in Jamnagar has also made a deal with a US based company West Texas Intermediate (WTI) Midland for 1 million barrels of oil. This is the first time when RIL has made a deal with US for oil as it is costing cheaper than the traditional market. The first crude oil shipment will arrive in November.

The total contract that has been made with US Oil Company is of 7.85 million barrels. These Indian firms have made an investment of $5 billion in US Shale Oil Production. Indian firms have also contracted for importing LNG from US whose delivery will start from January 2018. This is the first time after 1975 that USA has started exporting oil after former president Barack Obama lifted the ban in 2015.

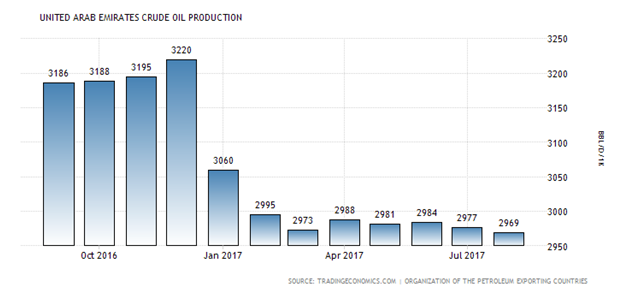

UAE’s Oil Production in Decline with Falling Exports

The world has found new alternatives for crude oil and that is costing UAE and other Arab nations. US’s Shale Oil production and the rise of solar energy has become a cause of worry for gulf countries. UAE has cut down its oil production with the decline in exports. UAE produced 3220 thousand barrel of oil per day in December 2016 which has now reduced to 2969 BBL/d/1K in August 2017.

Experiencing loss in revenue from oil export, UAE has planned to introduce VAT from 2018. The rate of VAT will be 5% on specific goods to generate revenue from alternate sources. If the same trend follows, it would be a matter of only 5-10 years when the Arab oil economy will collapse as the major energy consumers are switching to alternate energy sources.

Pingback: Top September Earnings (Q2) Reports to Watch Out This Month

Pingback: Oil – The Emperor of the World & How India is befriending the Emperor?

Pingback: Rising Oil Price Becomes Headache for Modi Government