Last couple of months, the headlines are filled with data & opinions on state of Indian Economy and most of them are negative.

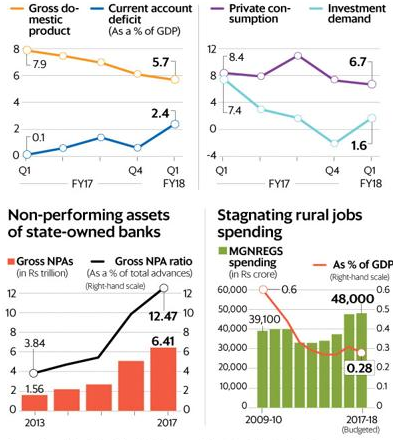

- GDP for June 2017 quarter is at 3 year low of 5.7%

- NPA of Nationalised banks at almost 12.5% of advances

- GST Go-live and related implementation issues & confusions

- Job losses & lack of new job creation

- Continued Debate on Demonitisation

None of these are factually wrong. There are enough data to suggest that Indian economy’s current report card is not something to be over zealous.

Even ruling party sympathisers are voicing concerns and blaming the ruling party for this. This is an indication that there is widespread sense of panic. I will shy away from politics & blame game.

Indian Economy – The Informal Sector

India’s lifeline is more the informal economy than the formal economy. Informal in the Indian context does not mean illegal but refers to those about which there is no robust data with government.

Informal economy was completely dependent on cash and demonitisation has hit this sector hard. ‘Mudra’ bank had the vision of regulated & structured approach of funds reaching individuals in this sector but it has hardly achieved it. They are borrowing at exorbitant rates & employment has taken a hit.

To add fuel to fire, food price deflation has lead to farmer worries. As a response to this problem & coinciding with state elections, 4 states have so far announced farm loan waivers – MH, UP, PB & RJ. Beyond short term relief & potential election win, farm loan waivers do not create material positive impact either for the farmers or for the state.

The resolution measures need to get to top gear & acceleration quite quickly.

- MUDRA bank vision must be implemented in one form or another. Money has to find a way to reach the common man in the villages at a reasonable price.

- Safety net mechanisms like Mahatma Gandhi Rural Employment Guarantee Scheme (MGNREGS) should be implemented better.

- Agricultural reforms are said to be high on agenda and corroborated by NITI AAYOG too. However, action is needed in specific areas like farmers getting direct access to customers reducing the layers of middlemen.

- Agriculture related tangles of State v Central must be smoothened. Currently many products are being sold by farmers at less than MSP (minimum support price).

- Revisit the proposed cattle ban measures to make it suitable & in line with real culture & traditions rather than perceptions.

- Fiscal push (increased government spending) seems inevitable but focus should be in rural infrastructure development – rural roads, housing, agri infra like irrigation facilities etc.

- Longer rope of support in implementing GST for specific sectors brought into the Tax ambit recently (like Handicrafts).

Quoting Mr Pronab Sen, former chief statistician of India – “Think small, not big and begin now”

Indian Economy – The Formal sector

Apart from the cascading effect of informal economy problems, India’s formal economy has two-fold problems – 1) GST implementation (especially along with Demonitisation, Ind AS go-live in the recent past of 3-6 months) & 2) Twin Balance sheet problem – Debt concerns of corporate & NPA concerns of Banks.

There has been numerous escalations & highlights on how bad the GST IT infrastructure is. Implementation issues have been frustrating and is a sad reminder that as a country we really need to improve on Program management skills. However, I’m quite optimistic that in 6 months’ time these issues would all be distant memory and real fruits of GST will start coming to light more effectively.

Corporate debt problem

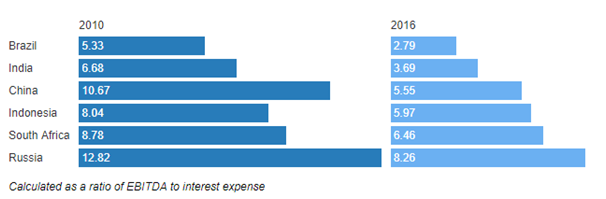

This is a real complex monster. Prima facie metrics of comparing debt to GDB does not sound alarm bells for India. It is lower than most of the big nations.

What is really concerning is Corporate India’s Debt servicing ability a.k.a Interest Coverage ratio. It is steadily declining indicating that corporates ability to service debt is declining. Also, it compares poorly to other emerging economies globally. Biggest concern is in the Telecom sector where the ICR is below 1.

This could be attributable to high interest rate, increased debt ratio in balance sheet, excess capacity and lower profitability. Debt has been building up since 2009-2010 when Interest rates were lowered when fiscal deficit went up to 6.4% of GDP.

ICR comparison

NPA Concerns

Corporate debt servicing problems have naturally led to the NPA problem for banks and there are worrying estimates (Credit Suisse Research Report from Sep 2016) that NPA could peak at 16%.

There is serious traction on reviewing NPA norms, Bankruptcy & Insolvency norms which is a welcome move. End of the day a more effective legal backup for collection, restructure and write-off where necessary is required. However, adoption of international BASEL Norms directly will be detrimental. As I have said many times before the law of the land should be in line with culture of the land. Aggressive lending restrictions, premature NPA classification & bankruptcy proceeding will be detrimental. As Mr S. Gurumurthy quoted – NPA because of wilful default and NPA because of market forces should be clearly classified and dealt separately.

What should RBI & Government do?

With the disclaimer that I’m not an economist, I will restrict my opinion to lay man understanding and to the extent of my research & reading.

RBI action

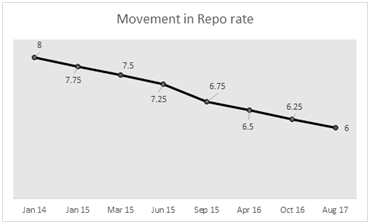

There is wide spread ask for RBI rate cut. It is logical that lower interest rates will increase economic activity, leave corporates & individuals with more free cash to invest. In most probability RBI will reduce the interest rates in the upcoming season.

What is important is to calibrate our expectations from a rate cut. Rate cut will increase inflation, weaken rupee, fuel prices might go up further with a cascading effect on prices. Further a reduction in interest rates will reduce interest on deposit rates and that will dent the income from savings of household as deposits is the biggest house hold saving avenue. My guess is that Rate cut will be there but not material enough.

Further, rate cut is not a new phenomenon and has been happening over the last few years. Economy is in this state despite rate cut. I’m not bullish that banks are in a position to pass on the benefit of rate cut to customers fully owing to their NPA, Provisioning & profitability concerns.

Government Action

Almost entire corporate, administrative & economics fraternity is calling out for increased government spending a.k.a Fiscal push to enable economy to come of out this current state. It is again quite logical that if government increase expenditure in infrastructure build-up, structural changes with a PPP model, there is bound to be increased economic activity & increase revenue for the Indian corporates.

I think fiscal stimulus has always been a short-term solution paving way for a bigger problem in the longer term. Drawing parallel to domestic scenario, we can never come out of a sticky financial situation by borrowing more money & spending them, unless you are lucky or have a very clear investment plan that will surely yield great returns. It is not prudent to bank on luck or not being conservative when it comes to governance.

Further increased fiscal stimulus comes at a few big costs:

- Increased borrowing most like will lower the country’s credit quality & rating impacting foreign investments.

- It will deteriorate the Fiscal deficit situation which the country has done very well in the last 4-5 years to bring down to a manageable 3% from highs of 6.4%.

- It will depreciate the rupee which might benefit exporters marginally but will impact almost the whole country negatively.

There are feelers that Government is fine to fall short of their fiscal deficit target by 0.5% to increase spending. They must be very calculative and cautious in spending.

End Note

Money is fungible. It chases assets that yield high returns and, at the same time, investors do want their money back, hence, one must keep an eye on how sound the balance sheet of a company or a country is.

Balance sheet strength is not built overnight and it takes time. Patience and continued journey in the path of structural reforms is key to long term sustained results. There is a lighter note anecdote floating around that ‘foreigners are more positive about India than Indians’. Turn-around will take time and not just a quarter on quarter phenomenon.

I would love to nudge the readers to be positive about India’s fundamentals and that the turn-around is just matter of WHEN and not IF.

Pingback: Direct Tax Collection Up by 15.8% till Sep' 2017; Good news for Modi Govt