Indian Rupee today touched the level of 71.97 against dollar, but then recovered slightly to close at 71.70 per US dollar. There are several reasons for the weakness in Indian rupee that comprises of crisis in the emerging market currencies, continuous rise in the crude oil prices and bearish dollar index sentiments.

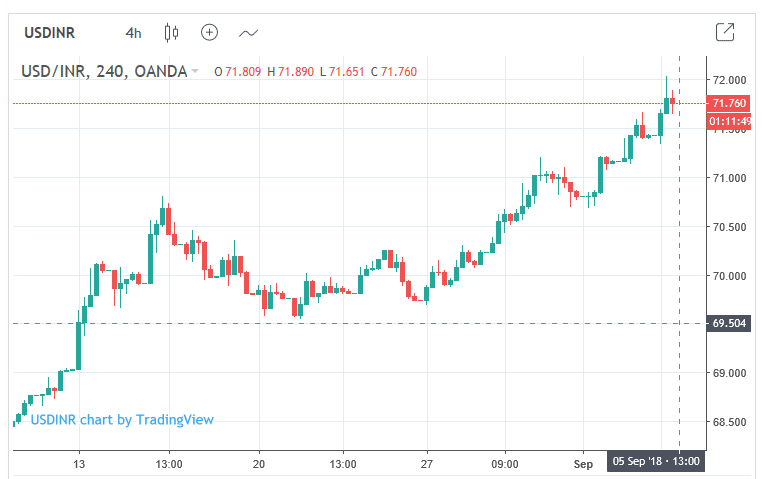

USD/INR Chart

Indian Rupee is amongst the worst performer in Asia this year. From the above chart 70.692 is an immediate support. On the upper side, the analysts are expecting that the rupee should not fall beyond 73 level. Reserve Bank of India (RBI) is expected to further tighten monetary policy to combat the sustained weakness in rupee that added worries of widening of current account deficit. As a result, the central bank is loosing reserves at the faster pace. RBI meeting is scheduled to take place on October 5, 2018.

Reasons for Weakness in Indian Rupee

- Trade tensions between the US and other countries: The dollar is strengthening as there is an expectation of 25 basis point hike in key interest rate by Fed. Further, there is a rise of fear due to trade tensions between the US and other countries. Therefore, the investors are investing in US dollar, which is considered as the safe heaven during this crisis period. The President of US, Donald Trump has threatened to pull US out of WTO. According to him, there is no requirement or need for Canada to be in the North American Free Trade Agreement. He has warned Congress not to interfere in between the talks to revamp NAFTA or otherwise he would terminate the trilateral pact altogether.

- Weakness in Asian Currencies: Some of the Asian currencies has witnessed free fall, which had a direct effect on rupee on the back of negative sentiment in the market. For example: Turkish lira has fallen about 85% this year.

- Rise in Crude Prices: The continuous rise in crude prices (trading at $78 mark) had a negative effect on Indian Rupee. There is a fear in the market that Iranian oil output will fall further after the US sanctions become effective from November. Further, the oil price rose due to potential supply disruptions on the back of a hurricane forecast to hit the U.S. Gulf Coast.

Weakness in Indian rupee is having adverse effect on stock market. The rupee has already fallen to a record level, therefore the upside seems to be limited for USD/INR and may reach maximum to 73.

Pingback: Indian Economy: Trade Deficit and Rising Oil Prices