Insolvency is a situation in which an organization or individual is not able to meet its obligation to its lender. The legal course undertaken then is ‘filing for a Bankruptcy’. These matters are now covered by the Insolvency and Bankruptcy Code. This will enable companies to easily exit the market in case of insolvency keeping the markets competitive.

Features of the Insolvency and Bankruptcy Code

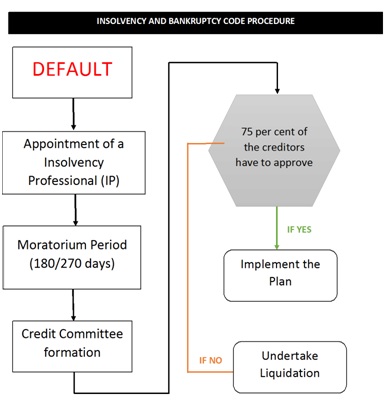

Insolvency and Bankruptcy are covered under multiple laws in India, as a result resolution get delayed. To enable faster resolution, The Insolvency and Bankruptcy code was brought in place. The code aims to resolve issues in a time-bound manner. The resolution is undertaken by professional or agencies who expertise in these matters. They are being regulated Insolvency and Bankruptcy Board of India.

Disputes between companies over bankruptcy are being exclusively handled by the National Company Law Tribunal. Disputes concerning individuals will be handled by Debt Recovery Tribunal. The specific division for work is aimed at expediting resolution process.

Some Challenges

Supreme Court Judge A.K. Sikri recently pointed out that it is a challenge to implement the Insolvency and Bankruptcy code successfully. A problem that he identified is the difficulty in interpreting the law. This will delay dispute resolution which then fails the entire purpose of the Code.

Another important issue that has not been covered in the code is cross-border insolvency. India could adopt the UNCTRIAL Model Law on Cross – Border Insolvency. Or else, courts and insolvency professional will struggle to resolve cross border cases.

It’s Relevance the way forward

Despite these challenges, Insolvency and Bankruptcy code remains a game changer for the Indian economy. It is presently being used to address the problem of Bad Debt in India. RBI is also empowered to take up Non Performing Assets cases under the Insolvency and Bankruptcy code.

ICICI Bank filed the first case under IBC against Starlog Enterprises Ltd to National Company Law Tribunal.(NCLT). In its final judgment NCLT imposed a penalty of Rs50, 000 on ICICI Bank for stating an incorrect claim amount. Most recently State Bank of India has petitioned against Essar Steel with the NCLT.

The Government is also working on developing a simplified Insolvency and Bankruptcy code for partnership and proprietorship firms, the legal form that most small and medium enterprises (SMEs) take. Significant employment in India is generated by the SME sector, the presence of an efficient and low-cost insolvency code will facilitate quicker disposition of capital in case an enterprise fails.

Pingback: Why Russian Company Rosneft Took Over Indian Essar Oil?

Pingback: Indian Economy & Negative attention - What is wrong & What Next?