HDFC Bank and Kotak Mahindra Bank both today have come up the third quarter results for FY201718 today. HDFC Bank Q3 Results showed highest ever quarterly profit due to the improvement in its margin and asset growth. Further, HDFC Bank has entered the coveted league of top five firms by market capitalisation on BSE after crossing Rs 5-lakh crore market capitalisation threshold. While Kotak bank’s profit grew due to the higher interest and fee income and as bad loans dropped.

Kotak Mahindra Bank Q3 Results And Market Reaction

Kotak Bank stock rose after reporting in the third quarter, the net profit growth of 19.72% to Rs 1053.21 crore on 12.48% growth in total income to Rs 6049.02 crore over Q3 December 2016. The stock had underperformed the market over the past 30 days

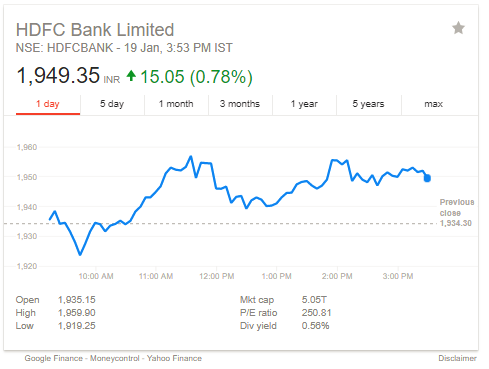

HDFC Bank Q3 Results And Market Reaction

HDFC Bank stock rose after the bank reported 20.1% growth in the net profit to Rs 4642.60 crore on 17.84% rise in the total income to Rs. 24450.40 crore in the third quarter 2017 over Q3 December 2016. However, as per Bloomberg analysts’ estimates, the bank was expected to report a net profit of Rs. 4,706.90 crore.

Non Performing Assets (NPA) Issue

Kotak Mahindra Bank’s gross non-performing assets (NPAs) stood at Rs 3714.99 crore as on 31st December 2017 as compared to Rs 3814.17 crore as on 30th September 2017 and Rs 3177.88 crore as on 31st December 2016. Therefore, NPAs fell from the previous quarter.

Kotak Bank’s ratio of gross NPAs to gross advances stood at 2.31% as on 31st December 2017 as compared to 2.47% as on 30th September 2017 and 2.42% as on 31st December 2016. The ratio of net NPAs to net advances stood at 1.09% as on 31 December 2017 as compared to 1.26% as on 30 September 2017 and 1.07% as on 31 December 2016. Overall the asset quality improved from the previous quarter

Meanwhile, HDFC Bank’s gross non-performing assets (NPAs) stood at Rs 8234.88 crore as on 31 December 2017 as compared to Rs 7702.84 crore as on 30 September 2017 and Rs 5232.27 crore as on 31 December 2016. Therefore, NPAs increased from the last quarter.

The ratio of gross NPAs to gross advances stood at 1.29% as on 31 December 2017 as compared to 1.26% as on 30 September 2017 and 1.05% as on 31 December 2016. The ratio of net NPAs to net advances stood at 0.44% as on 31 December 2017 as compared to 0.43% as on 30 September 2017 and 0.32% as on 31 December 2016.

Kotak and HDFC Bank Share Price Outlook

Overall banking stocks have performed well in recent times. As per the analysts’ consensus Kotak Mahindra Bank stock is expected to “outperform” with a target of INR 1100 and HDFC Bank stock is also expected to “outperform” with a target of INR 2100.

Pingback: HG Infra IPO Subscribed 0.44 Times on Day 2, Should you Invest?