Saving tax is utmost priority of citizens these days with increasing control of government over market. Government also promotes savings in the form on investments to help citizens save tax. Currently below are the tax saving investments option you can consider.

Under Section 80C: (Limit Rs. 1.5 lakhs per annum)

| Nature of Investment | Tenure/Lock in | Return | Tax on Return |

| Tax Saver FD | 5 or more years | 7-9% | Interest is taxable |

| Public Provident Fund | 15 years | 8-9% | Tax free returns on maturity |

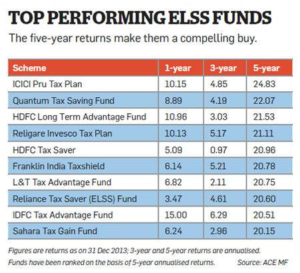

| ELSS Tax Saving Mutual Fund | 3 years | Depends on fund performance | Return/capital gain is tax free |

| Senior Citizen Saving Scheme | – | 9.2% p.a. | Taxable interest |

| Voluntary Provident Fund | Retirement/Resignation | 8.5% p.a. | Tax free Return |

| National Saving Certificate | 5/10 years | 8.5-8.8% | Taxable Interest |

| New Pension Scheme | Retirement/60 years of age | 4-10% | Taxable Pension |

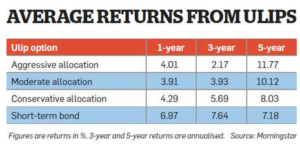

| Unit Linked Investment Plans | 5 years | 5-11% | Taxable Returns |

| Tax free Bonds | |||

| Term/Life Insurance Plans | 10-15 years cover | Risk Cover | Risk cover plan |

Pingback: Interest On Provident Fund To Be 8.65% Rather Than 8.8: - Finance Minutes

Pingback: Govt Cuts Interest Rates on Saving Schemes like PPF, KVP, NSC

Pingback: Why Only 1.5% Indians Pay Income Tax & 3% Assessed - Case Study

Pingback: Plan your Retirement with Govt Pension Security Plans

Pingback: Ten Measures Modi & BJP Govt Need to Revive Indian Economy

Pingback: Tax Saving Schemes like PPF, EPF Can Offer Easy Home Loans

Pingback: Sensex, Nifty Lowers: Right time to Buy Tax Saver Mutual Funds?

Pingback: Best ULIP Investment Plans to Achieve Your Financial Goals

Pingback: New to Mutual Funds? Avoid These 4 Mistakes