As expected by the market analysts and tax experts, Long term capital gains tax on equities and equity oriented mutual funds came back in Budget 2018. This caused a lot of panic among retails investors as they were worried about their huge gains accrued till date. Government has very smartly designed a mechanism to calculate long term capital gain (LTCG) using share price of 31st Jan 2018 for investors.

Long Term Capital Gain (LTCG) Calculation

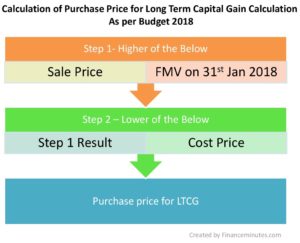

Step 1 – Determine Purchase price for the purpose of long term capital gain calculation

What is Sale Price?

Sale Price will be the price/NAV at which the security/stock/share/equity mutual fund will be sold in the market. This sale must be STT paid in order to qualify for the long term capital gain with reduced rate of income tax.

What is Purchase/Cost Price?

The price/NAV at which the security/stock/share/equity mutual fund unit was brought from the market. The purchase must be executed vide an STT paid transaction. There will be an exception for IPO allotment case as it is not an STT paid transaction. Though this is not explicitly mentioned in the budget document, it shall definitely come as a clarification subsequently.

What is Fair Market Value as on 31st January 2018?

As per the grandfathering provision, fair market value as on 31st Jan 2018 will be the highest quoted price during the trading session for the day. In case the stock was not traded on that day, last closing price can be taken as the fair market value.

Click here for the trade book/bhav copy of shares listed on BSE and NSE as on 31st January 2018.

Step 2 : Calculation of Long term Capital Gain/Loss Amount

Thumb Rule Conclusion for LTCG in for A.Y. 2019-20

IF Sale Price > Fair Market Value on 31st Jan 2018, there will be a Long term Capital GAIN.

IF Sale Price < Purchase Price, there will be a Long term Capital LOSS.

IF Cost Price < Sale Price < Fair Market Value on 31st Jan 2018, it will result in NO GAIN NO LOSS.

Tax Treatment of Long term Capital Gain as per Budget 2018

For all the long term capital gains accrued post 01.04.2018, taxpayers will have an exemption of Rs. 1,00,000. This exemption is only available to the individual taxpayers and not the corporate or partnership firms. Gains above Rs. 1,00,000 will be taxed at the reduced rate of 10% irrespective of the balance income of the taxpayer in the respective year.

Should you book Long term taxfree gains before 01 April 2018?

Panic selling happened on 02nd Feb after the budget announcement of LTCG. this selloff dragged Sensex by 839 points and Nifty by 256 points. There is a general assumption that an investor shall book all the gains till date and take full exemption of the gains.

However, this assumption is completely wrong, any investor shall not worry about the gains accrued till 31.01.2018. Investors shall only be concerned about the gain he/she will accrue between 01st Feb 2018 – 31st March 2018. If this gain is substantially high then an investor shall think about the option of booking long term capital gain by 31.03.2018.

Investors shall also consider STT and buy/sell price spread against probable tax saving before taking any call on booking long term gains and taking a new position.

It is clarified that Long-term Capital Gains on listed equities arising upto 31.01.2018 has been grandfathered for resident & non-resident assessees(incl. Foreign Institutional Investors). Refer clause 31 & 32 of Finance Bill, 2018 @PMOIndia @FinMinIndia @adhia03 @arvindsubraman

— Income Tax India (@IncomeTaxIndia) February 2, 2018

Looking at the post budget investors reaction, no surprises if the market takes a huge dip on 31st March 2018 where every investor will try to book maximum taxfree long term capital gain possible and re-book fresh positions.

Pingback: File Your Income Tax Return for FY 2017-18 Immediately, Know Why