The banking industry has undergone a transitional phase with digitalization at its helm. In order to further give the boost to the digital technologies, the government has introduced several bold measures and one among them is a reduction of SBI NEFT and RTGS charges by 75%. Yes!

After the recent spate of events (demonetization, reduction of IMPS), the country’s largest lender bank State Bank of India has finally decided to lower down the NEFT and RTGS charges. “The reduced charges will be applicable on the transactions that are done through the internet banking and mobile banking services offered by the bank.”

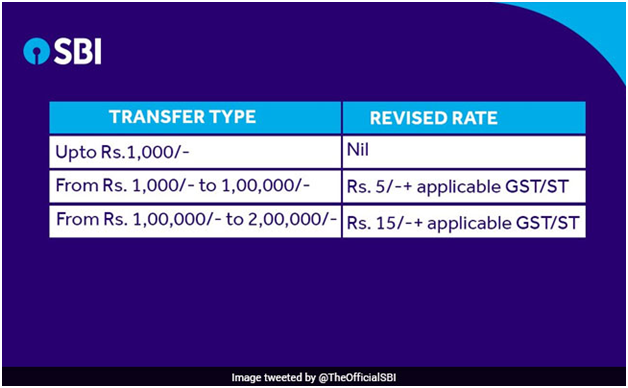

Further, the bank has announced to forfeit the charges for fund transfer up-to Rs 1000 if done through IMPS. This scheme will become effective from July 1, 2017.

Why the bank has taken such a bold measure?

To move in sync with the current times, the bank has taken such a step. It believes that,

Digitalization and excellence in operations is one of our core strategies in providing convenience to customers. It has resulted in reducing turnaround time along with extended benefits to the customers.

said Rajnish Kumar, managing director (NBG) at SBI.

What would be the charges levied by the bank?

With the introduction of the recent policy, the SBI has reduced the NEFT charges from Rs. 2 to Rs 1(excluding 18 percent of GST) for fund transfers up to Rs 10,000 using internet or mobile mode. For NEFT transactions above 10,000 to 1 lakh, the charges have been reduced to Rs 2 from earlier Rs 4. In a similar way, SBI has revised its charges for fund transfer between Rs 2 lakh and Rs 5 lakh through RTGS (mobile and internet) to Rs 5 instead of Rs 20.

Will it affect the profitability of SBI?

It is estimated that as on March 31, 2017, SBI had 3.27 crore Internet banking customers and nearly 2 crore mobile banking customers. This initiative will further attract more customers rather than adding dent on its profitability.

Was this step been taken under the pressure?

Well, you may so, the stringent policies of minimum balance charges ( to maintain Rs 5000 for saving account otherwise it will attract a penalty of Rs 100) issued by the State Bank of India has attracted a lot of frustration among the customers. To reduce this angst, the bank has finally decided to reduce the charges by up to 75 percent.

Does that mean interest cut is likely to appear soon?

This statement of the rate cut has definitely has seeded a positive sentiment in the air. Definitely, the time will decide whether the interest cuts will likely occur in the future or not.

Till then, enjoy this easy-on pocket journey.