Yesterday, Arun Jaitley announced a slew of measures for reviving the economy as the private investment is not picking up. One of the measures announced was to infuse fresh capital in to the public sector banks(PSBs) through a government bond.

It sounds to be a smart move however it’s only a half job done and government would need to provide a lot of information around its implementation.

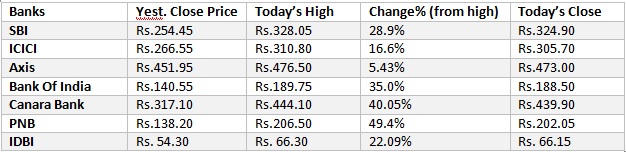

The markets have so far cheered the move by the government and major PSB stocks are traded at 20% higher than yesterday’s close.

Bank Re-Capitalization Plan: Rs. 2.11 lac cr.

In a major step, BJP government announced that the cabinet has approved Rs.2.11 lac cr. for recapitalization of the banks over the course of next two years to solve the twin balance sheet problem.

The fresh capital would come through issue of recap bonds from government that banks would purchase by means of surplus cash or raised money from the market. Thereby government would collect and distribute the money for recapitalizing the troubled banks.

Of the Rs.2.11 lac cr., Rs.1.35 lac cr would come from bond and Rs. 76,000 cr. would come as part of budgetary allocations. In the last budget, FM Arun Jaitley had announced disbursement under Indradhanush plan which stood at Rs. 18,000 Cr for the current fiscal year.

The disbursements under Indradhanush plan, which was introduced in 2015 budget, stood at Rs. 25,000 cr. in FY2015-16. The total outlay under the scheme is planned at Rs. 70,000 cr.

Arun Jaitley said, “Between 2008 and 2013, public sector banks engaged in indiscriminate lending, which led to the rise in non-performing assets.”

“It was decided that a bold step needs to be taken by the government to recapitalize banks,” he added.

The NPA Mess?

The problem that PSBs have in front of them is of a record Rs. 9.5 lac cr. worth of bad loans (NPAs) and the announced recapitalization of Rs. 2.11 lac cr. is 22% of the total that can only fix the problem to an extent if further steps are not taken.

Banks are further hit by higher provisioning requirement after RBI taking steps to control careless lending and at the same time, banks have to meet the new standards under Basel III capitalization norms and IFRS accounting to ensure a healthy balance sheet.

Among the lenders at the brink of a default, they are majorly coming from power, road infrastructure, steel and textile sectors. Government has announced a major reform for Road infrastructure ‘Bharat Mala’ that would help the sector to recover from economic slowdown and give jobs to people.

Is it a Smart Move?

So far with the details available, it is still unclear as to how government will get the money back from banks that are given the recapitalization fund. Is it going to be equity or another bond?

If it is equity, it is going to work against the plan of government under disinvestment and further classification would only add to the budget constraint as government has to pay the interests on the bond irrespective of type of bond it is.

It is estimated that interest on bonds would put an additional burden of Rs. 8,000 cr. on the annual budget hurting the common tax payer.

It would be a smart move if the government quickly identify the banks that need these funds the most and can be a possible candidate for a takeover or a merger that would help government earn back money invested for recapitalization.

At the same time, government would need to work very closely with RBI & banks to ensure that other investment schemes announced help the lenders to pay back their loans instead of going default.

Government can also take up an equity share in the merged entity that would ensure that the money is available with the bank and at the same time, government holds the new entity till the time it is stable enough with healthy financials.

In the end, it does look like a positive development however without any further reforms in the banking sector in form of lending, provisioning, mergers & acquisition, it would only do harm to the Modi Government and the common tax payer.

Pingback: Foxconn 6,000 Crores Investment In India, 40K Direct Jobs, BPO Jobs