Though there was rejoice in the market after SENSEX crossed the 35,000 mark, but after garnering the title of the least attractive emerging market for 2018, the investors have become more cautious. Moreover, the valuations have zoomed in and the strong bullish candle is predicted ahead, all these factors are making the investors to think about what kind of strategy they should adopt with multibagger stocks to remain ahead of the pack.

In this article, we have mentioned some multibagger stocks that may act as a breather and will help you to sustain.

Multibagger Stocks for 2018

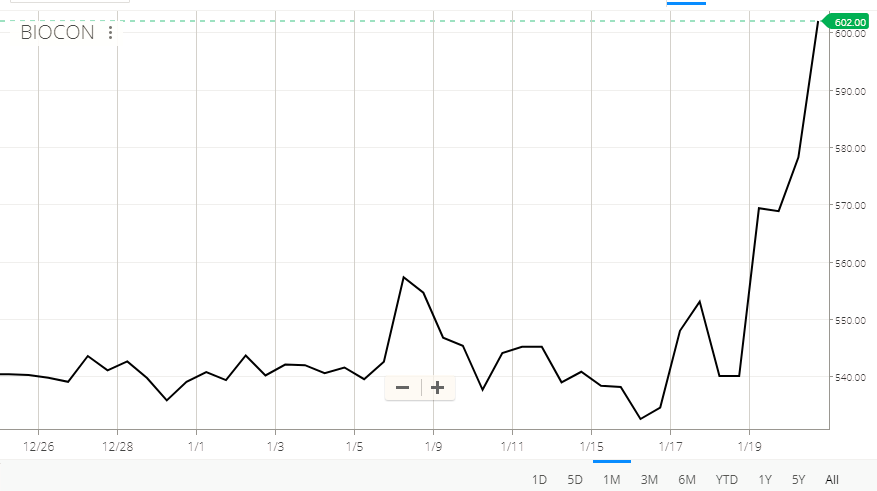

Biocon

Biocon has been in news for several alliances that it made with other pharmaceutical companies. This stock has recently witnessed price and volume breakout and has been continuously forming the higher top and higher bottom in all the degrees. The price has started forming Wave V pattern from the low of Rs 525 so it is believed that this stock has a high potential. Buying is indicated for this stock. The reason behind its volatility is the decline of pharma sector because of competition, pricing pressure, and stringent norms laid down by the regulator.

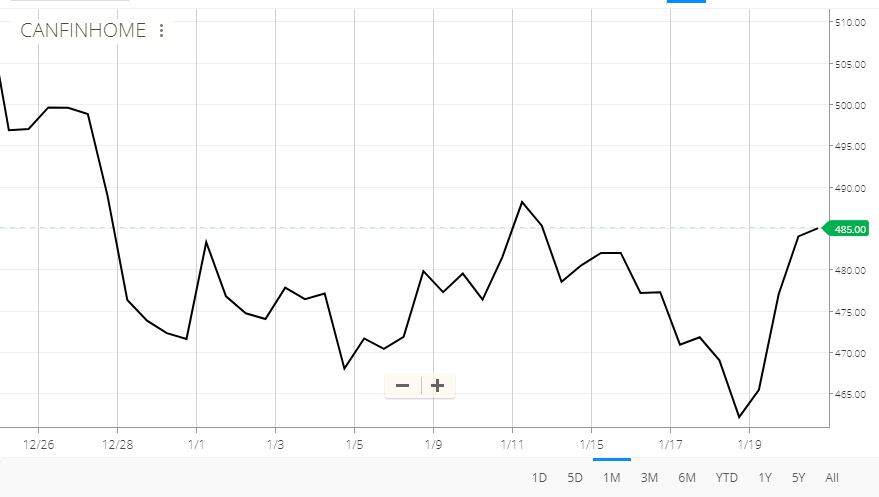

Can Fin Homes

The lethargic attitude in the real estate sector has not put the company like Can Fin Homes at a backdrop. The company is still growing by leaps and bounds, thanks to its focus on mid- size and small size housing loans and government’s stimulus to the affordable housing segment. The recent correction in the stock is due to the real estate slow down and this gives the opportunity to the long-term investor.

The other reasons that prompt the investors to remain invested in this stock are the company has good quality assets as its backup, diversified loans, rigorous loan verification process and conservative accounting practices. Hence, this company is definitely not plaguing the financial sector with losses. The analysts ask to buy the stock and if you have the scrip keep it on hold.

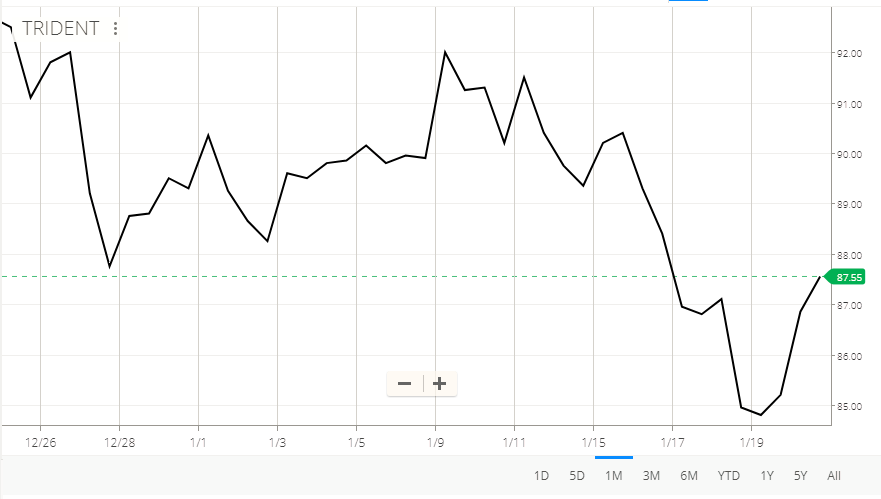

Trident

The poor performance in the second quarter of 2017-18 can be attributed to the rising competition from the foreign markets, and recent rupee appreciation. Though the company is facing nightmares due to its lackluster performance, but there is good news. The third quarter earnings are expected to be a bigger and better. More importantly, the company’s paper division has registered good numbers. The earnings before interest and tax have grown by 35% y-o-y. Further, its debt reduction strategy is helping it to cut down the interest rates. The analysts are asking not to waive off this opportunity and make the most of it.

KCP Sugars

KCP Sugars is facing a volatile situation, especially after the sugar prices have fallen in the last one month. The price of sugar in the retail market across the major cities have dipped by Rs 1-4 per kg in the last one month and in north-eastern areas, the prices have decimated upto Rs 9. While the industry sources have confirmed that the retail price of the sugar will not go beyond 40-42 per kg, but the price trend will be clear in the coming months.

Owing to all these factors the KCP Sugar and Industries Corporation closed at Rs 32.30, down by 1.97% and quarter FY 2017 net sales have decreased from Rs 189.90 crores to 112.70 crore. But there is no need to worry because the company has registered growth in profit after tax from 7.25 crore to Rs 10.26 crore, thanks to the decline in consumption of raw materials, the EPS is also showing an uptrend and has recovered from a negative zone. The studies show this stock should be kept on hold as of now.

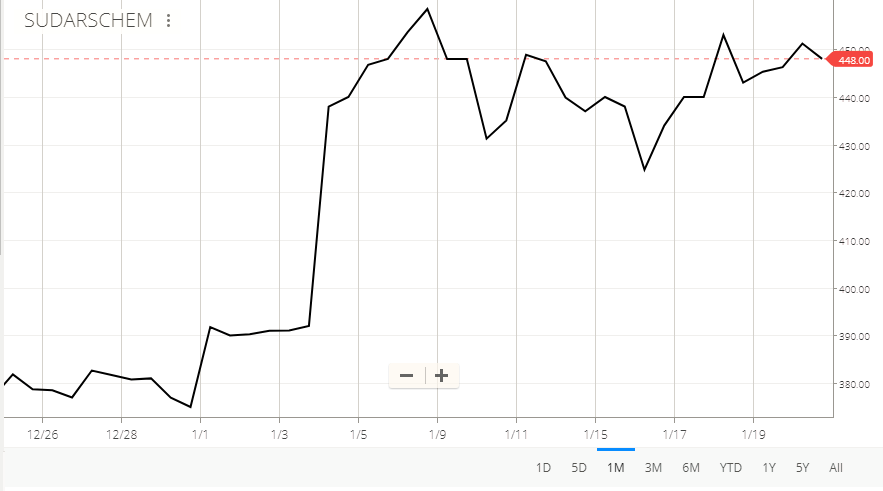

Sudarshan Chemicals

The chemical industries are facing the heat after pollution control boards of the state has laid the stricter norms. The production is under pressure and there has been no capacity expansion in this sector, this has dented the efforts of the entrepreneurs. Sudarshan Chemicals is one of the most affected companies in this sector. But the analysts give it a buy tag because it has strong key fundamentals like total current liabilities is on the decline, current assets are increasing by 6.98% and total sales have increased by 7.18%, the PAT has also been increased by 24.82%. All these factors indicate towards the fact that the stock will yield returns in future.

In the end, we would like to conclude that though these stocks are facing pressure, however, it is predicted that in the coming months these stocks will continue to yield returns.