This year can be dedicated to IPOs. Various insurance companies have bombarded the market with an intention to raise the public capital. New India Assurance is one among them. Now, let’s have a look whether you should subscribe to it or not.

Sneak peek about the financial details of the company

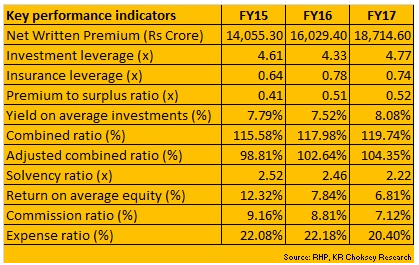

New India Assurance is a leading insurance company that offers indemnity bond to the customers in several areas like motor, auto, third party, mediclaim and commercial insurance. The company has reported global premium of Rs 18,714 crore and PAT of Rs 1008 crore, the growth of 21.27%. The net worth is reported 34716 crore. Here’s a table indicating the same.

Image Credits Moneycontrol

Details about the IPO deal

The state run company is planning to raise an IPO worth Rs 9600 crore, with a price band of 770-800 per share.

The general insurance company is selling 12 crore shares with a face value of Rs 5 each and out of which 2.4 crore shares are issued freshly and 9.6 crore shares are on an offer for sale. The total IPO will include 14.56 percent of paid up share capital of the company. The retail investors and qualified employees will get a discount of Rs 30 per share. The bids can be made for 18 shares and multiples of 18 thereafter.

Who are the lead managers of the offer?

The banks like Kotak Mahindra Capital Company, Axis, IDFC, Nomura Financial advisory, Yes Bank are managing the offer.

Where will the proceeds be used?

The government owned insurance company plans to use its proceeds for augmenting its capital base and expansion of the business. Through this, it also wants to improve its solvency margin and solvency ratio.

When will the offer get closed?

The offer opened on 1st November and will be closed on 3rd November. Allotment of shares will be finalized by 08th November and trading to commence on 13th November. The company plans to dilute its stake by 14.13%.

Should you invest or not?

Well, the initial public offering of state owned insurance company was fully subscribed, thanks to LIC, who bided Rs 6,500 crore. The reports confirm that the offer was oversubscribed by 1.04 times, on the first day of its sale and it will continue to show the positive signal.

“The portion of shares reserved for institutional investors in the NIA IPO saw a subscription of 2.13 times on Wednesday, while those reserved for retail investors and high net-worth individuals (HNIs) were subscribed 2% or 0.02 time each.”

Recent insurance IPO such as SBI Life insurance gave only 5% listing gain on opening and 1% net gain on day 1 close. Going by the details, it is recommended to invest your money in this IPO with a long term perspective.