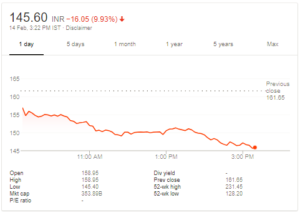

PNB, which is the country’s second-biggest state-run lender and fourth-biggest overall by assets, PNB stock price fell nearly 7.8% after bank the detected the fraudulent transactions of worth USD 1,771.7 million in one of its Mumbai branch.

The fraudulent transactions are the equivalent of eight times the bank’s 2017 net income of approximately 13.2 billion rupees ($206 million). The impact of PNB fraud could extend to other lenders as well, however the bank did not give details regarding it as well as did not elaborate on what impact the fraud may have on its finances.

Moreover, this fraud leads to further questions about the health of India’s banks, that are already struggling with one of the worst bad-loan ratios among big economies. Further it poses a challenge as around two years back 12 other lenders were fined for violating rules on approximately $1 billion of foreign-exchange deals.

Meanwhile, PNB has reported the transactions to the law enforcement agencies, and would evaluate later whether the bank faces any liability arising out of the transactions.

PNB Fraud Detection at Mumbai Office

It is unclear if the fraud is linked to another case of PNB that the bank had reported earlier this month, where a jeweler had allegedly acquired the fraudulent letters of undertaking worth 2.8 billion rupees from PNB in order to obtain loans. At the time PNB had said it investigating the records to find out if the loss is much deeper or not

The shares of other public sector banks came under pressure after Reserve Bank of India (RBI) tightened the rules around bank loan defaults, in order to push larger loan defaulters towards bankruptcy courts and abolishing half a dozen existing loan-restructuring mechanisms.

Further, after the detection of PNB fraud, PNB will have to go for higher provisioning, which will hurting the finances of bank. As a result of PNB fraud, the index for PSU banking stocks on NSE was down approximately 2.5 per cent.

PNB Q3 Earnings and Stock Price Analysis

Source Google Finance

PNB for December quarter has reported lower than expected earnings as the bank has reported 11% growth in the Profit to Rs 230.11 crore and net interest income grew 7 percent to Rs 3,989 crore year-on-year, which were below the analysts’ expectation of Rs 558 crore and Rs 4,123 crore, respectively.

However its asset quality has improved sequentially as the gross NPA were lower at 12.11 percent compared to 13.31 percent in previous quarter. Moreover, the provision for bad loans is at higher levels, as it increased 80 percent quarter-on-quarter and 74 percent year-on-year to Rs 4,466.7 crore in the third quarter.

With current PNB Stock prices, Long term investors can “Hold” the stock with a horizon of more than one year.

Pingback: Sensex Today: Tata Steel Top Loser, Reliance and Axis Bank Top Gainers Today

Pingback: PSU Bank Share Price Slump: Should You Buy, Sell or Hold?

Pingback: Bank NIFTY Technical Analysis: Bearish Signals Emerge

Pingback: USD to INR Forecast: Indian Rupee to Decline Further Versus US Dollar

Pingback: Simbhaoli Sugars and OBC Share Price Plunge: All You Need to Know

Pingback: SBI Hikes Fixed Deposits Interest Rate; Compare Bank FD Rates for March 2018