Today’s trending stocks like Prataap Snacks, L&T and Vadilal may be considered by the investors to invest currently. Prataap Snacks has planned to enter Gujarat with the acquisition of 80% equity stake in Avadh Snacks Private Limited. Larsen & Toubro has approved its buy back offer. Vadilal Industries Ltd stock surged and showed marvelous recovery from its low.

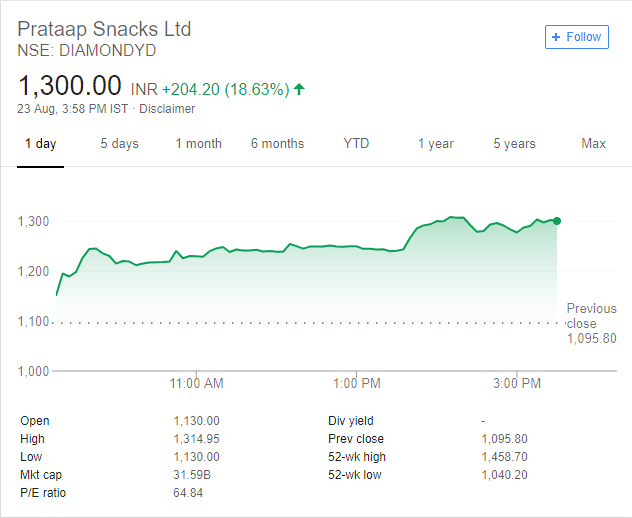

Prataap Snacks Ltd. (NSE: DIAMONDYD)

The company plans to enter Gujarat, which is the largest snacks market in the country with the acquisition of 80% equity stake in Avadh Snacks Private Limited for a consideration of Rs 148 crore. Prataap Snacks is one of the fastest growing snacks food companies and the acquisition of Avadh Snacks will help the company to accelerate growth. Further, it will deepen the company’s presence in an important market of Gujarat.

Meanwhile, Sequoia Capital invested a total Rs 265 crore in Prataap Snacks in 2011 and after its recent listing, Sequoia still holds a minority stake in the company. Afterwards, Aditya Parekh-led private equity firm Faering Capital invested in the company. On the other hand, Avadh is well positioned to expand in its home market and further in new geographies and innovative products. The long term target is Rs.1700 with a time horizon of one year

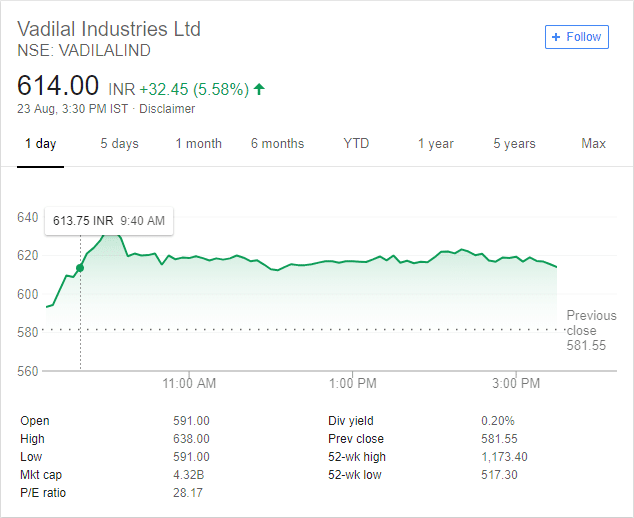

Vadilal Industries Ltd. (NSE: VADILALIND)

The company had hit the 52 week low two days back on heavy volumes as the ace investor Mr. Kacholia took out approximately Rs 30 crore after selling the stake. Now his ownership has fallen to only 0.21 percent from 7.21 percent as of June.

Meanwhile, Vadilal for the first quarter of 2019 has reported 28% growth in the profit on year on year basis and the company’s operating margins expanded by 550 basis points to 24.2 percent on the back of higher volumes, lower input costs and focus on efficiencies.

However, revenue fell 4 percent to Rs 229 crore during the first quarter 2019. Today the company’s stock recovered from its low as it surged more than 5%. The company witnessed strong 9% volume growth in India during the peak ice cream season this summer. The long term target is Rs.800 with a time horizon of one year

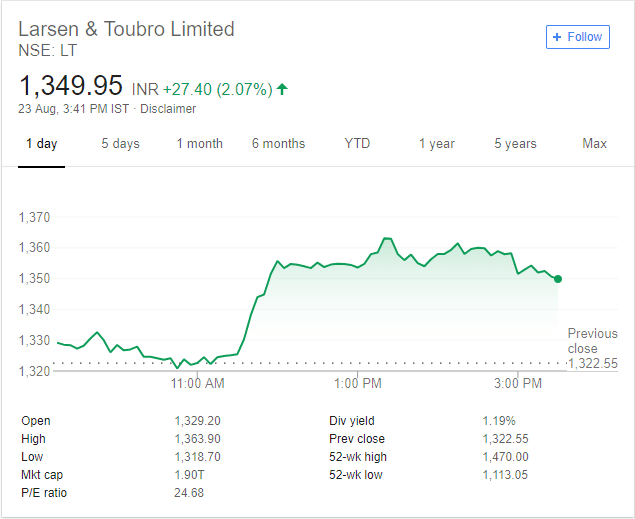

Larsen & Toubro (NSE: LT)

Today the company has approved Rs.9000 crore buyback, which is 4.29 per cent of the total paid-up equity share capital, at a maximum price of Rs. 1,500. However, this buyback of shares is subject to approval of the members by means of a special resolution through a postal ballot. The long term target on the stock continues to be Rs 1750 as informed earlier with a time horizon of one year.

Overall, the investors may consider these above trending stocks to get the benefit of rally.

Disclaimer: This is author’s personal opinion and readers are advised to perform their own research before investing.