Nifty PSU Bank index has fallen approximately 18.1% in the last 30 days and some banks are off than 30%-40% from its 52 week High. In coming years, the current and future finance minister need to pour money into public sector banks, which are having a record pile of bad debt and corporate fraud.

The PSU bank stocks are falling as the exposure of in the alleged fraud involving jeweller Nirav Modi, his relatives and associated companies may be approximately Rs 20,000 crore, which is approximately twice the initial estimate. The billionaire jeweler Nirav Modi had allegedly acquired the fraudulent letters of undertaking from a branch of PNB in Mumbai to get overseas credit from other Indian lenders.

The finance ministry is expected to call a meeting of all state-run banks, which could be soon as next week, to ensure that all accounts of the entities said to be involved are traced and the exact extent of any fraud gets ascertained. The meeting will assess the total exposure, steps taken by banks and the further course of action.

Let’s have look on some PSU bank stocks. The PSU banks are trading currently to their 52 week low level.

PSU Bank Stocks Decline: Recent Frauds

Union Bank of India, Allahabad Bank and Axis Bank are said are expected that they have offered credit based on letters of undertaking (LOUs) issued by PNB. On the other hand, Allahabad Bank, Bank of India, Bank of Baroda, Indian Overseas Bank and Union Bank of India have compromised their rules to sanction loans to Rotomac. A complaint has been filed against Rotomac Pen promoter Vikram Kothari for a loan default of Rs 800 crore. As a result, all the mentioned PSU Banks stocks have significantly fallen.

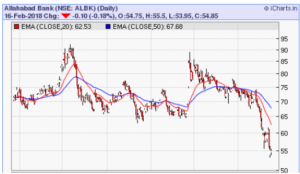

Allahabad Bank

Currently trading at the level of ₹50 with a 52 week high of ₹92.40. The next level it may reach is 65, support is at 45. The bank has disclosed Rs 2,000 crore exposure in PNB fraud.

Indian Overseas Bank

The banks touched 52 week low today. It can go to level of ₹24 on recovery. It’s Rs.600 crore cheque bounced due to Rotomac fraud.

Bank of Baroda

Trading between ₹ 130 to ₹ 150 band. In case of recovery it may go to ₹ 150 level.

Bank of India

The bank’s stock price touched 52 week low today. It can go to level ₹160 on recovery.

Overall, the banking stock that can be accumulated at the current price is Bank of India, whose third quarter result was disappointing due to rise in NPAs. This is because, the bank is expecting to reduce net NPA to around 3 percent before March 2018.