It seems the largest lending bank of India, State Bank has tightened its seat belt to fight against the pressure mounted by the government of India. In order to reduce its NPA, and increase the revenue, State Bank has taken a stern step to review the monthly minimum balance requirements of saving account holder.

What is the Minimum Balance that an account holder has to maintain?

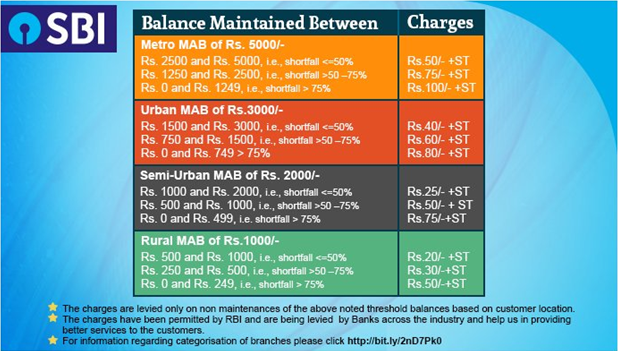

According to MAB rules, a customer has to maintain Rs 5000 as a minimum balance if you are living in the metros and Rs 1000 for the rural areas. In case, the said amount is not maintained the bank will deduct the amount and GST from it. Here is an illustration for the same:-

If you are a savings bank account holder in SBI metro branch, and your average maintained balance is between Rs 2500, which means there is a shortfall of 50 percent amount, so the bank will charge Rs 50 plus a service tax will be levied on it.

Charges levied by the bank in case of a shortfall

Following Charges were announced by the bank in June 2017:

Source Official SBI Twitter Handle

SBI Collected Rs. 235 Cr in the first quarter of current FY as penalties. The penalty will be reintroduced after 5 years.

Exemption to the rule

However, the minimum balance requirement rule won’t apply for the various schemes launched by the government like Surabhi, PM’s Jan Dhan Yojana or to the Basic Savings Bank accounts.

Account holders of the following types of accounts are exempt from requiring to maintain an average monthly balance: pic.twitter.com/qNrsGQm8Oi

— State Bank of India (@TheOfficialSBI) September 16, 2017

In its recent review, SBI has given an additional exemption to Basic Savings Bank Deposit (BSBD) Account from minimum balance requirements or charges thereof. Existing customers can also opt for conversion of their account to BSBD account free of cost with no change in rate of interest.

Will other banks follow the league?

Well, SBI has introduced a list of penalties starting from minimum balance to transaction charges after the private banks announced this move. The banks like HDFC, ICICI, Axis has started charging the customers for not maintaining a minimum amount and for transacting more than prescribed (4 transactions) limits. These charges would be applied to both savings account and salary account.

If one maintains Rs 25,000 is SBI saving account, then the customer can use ATM for an unlimited number of times.

Pingback: Buy SBI, RIL, ICICI, Bodal Chemicals; Invest with Medium-Long Term View