George Soros is reputed to have made a fortune betting against the market, and he is not the only one who has done so. Several investors are lining up behind this known market tip in a new wave that could be indicative of an impending market crash.

When bets are made, they take the form of a put or a sell option, and this means that investors will either be holding on to their stock, buy or sell off instead.

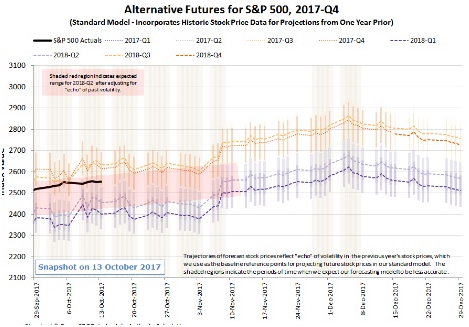

S&P Alternative Futures

What is the bet like?

As the stock market seems to enter a motionless mode, many investors are taking a short bet using the CBOE volatility index as a buffer. The better known name of the index is the S&P fear gauge and what it does is to measure the volatility of the blue chips on the S& P Index.

The quantum of short bets against the market is recorded to have soared following the price lows that have been seen in weeks. The size of the bets has been identified as the fourth largest in recent times following the publication of the data by the Commodities Futures Trading Commission in the U.S.

The Volatility Index for 10/17/2017

The Beneficiaries

In a move that did not go unnoticed in August 2017, Seth M.Golden made known the mode he put to work in shorting the VIX to spike his net worth from just $500,000 in 2013 to $12 million in 2017.

One of the best known VIX shorting mechanisms is the Ultra Short Term Futures. This investment vehicle is recorded to have seen more than $14 billion in inflows since 2012. Several players are making more money using this vehicle by the day.

Short Dipping

The best known practice in getting against the market is the deployment of the trade inverse form of “buy the dip”. How this works is to stretch long positions when market weakness increases, and this means that the bets will spiral in the scenario before shorting them.

While established bankers have warned that betting against the market could lead to monumental reverses when the market recovers in the short term. There are several hedge funds that bet against the market along with several billionaires like George Soros and John Paulson. John made billions of dollars after betting against the subprime lenders in the 2007/2008 upheaval.

The latest market fears

The market fears that have arisen of late can be situated on the premise that there has been a long unbroken run for markets since the last 2008 panic. The market crash is so described whenever there is a drop that amounts to a double-digit drop over a couple of days in the market index.

Loss of investor confidence is a major reason for the crash and this can result when a major economy faces a debt rescheduling problem, or there is an outbreak of war, among others. As investors panic and drop their shares, prices are bound to plummet, leading to gargantuan depletion of the market index.