Gone are the days, when people used to save money in their lockers, bank accounts, and post office account. With the spike of inflation and change in the government policies all these traditional options have become obsolete.

Keeping all these things in mind, there are a couple of investment options like mutual funds, equities, gold and real estate that can help you to accumulate a corpus in the long run. If you have not started thinking about it, go ahead and start it now, as money will get compounded and multiplied over a period of time.

Investment in Equities

Equities has delivered more than 1000 percent returns in the last 15 years. The Sensex has surged from 2960 level on November 2002 to over 33,000 marks, creating an impression that best is yet to come. Here are some stocks that are worth investing.

Hero Motor Corp

The two wheeler maker has not only made India proud with its advertisements that hint towards cultural and demographic change, but also with its efforts to keep in sync with the modern generation needs. And maybe this is the reason why the stock has rallied better than its contemporaries.

Five years before it was trading at 1816 and presently it is standing at 3650 with nearly 100% return on investment. What’s more! The global research and brokerage firm Macquarie have improved the target prices on the shares of Hero Motor Corp. Thus, floating a positive sentiment in the air!

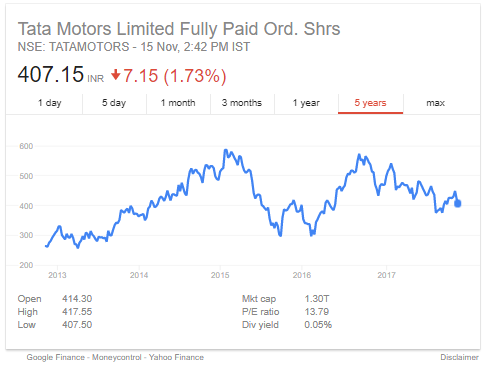

Tata Motors

The pollution levels have crossed our nostrils and entered in our heart, lungs and other body parts. Thus, creating havoc to our health. Keeping this in mind, the government has launched an initiative to reduce the carbon footprint by adopting energy saving measures. Tata Motors is a fine example of it.

Recently, it has signed an MOU with Energy Efficiency Services to promote conservation of energy. This energy efficiency program will be implemented in their manufacturing facilities in India. With 57% return the stock rose to 412 from 261 in five year’s time frame. There is a ray of hope that it will increase further.

Mahindra and Mahindra

While juxtaposing the shares of Mahindra and Mahindra with Tata Motors, we have found a similarity. Yes! Both are on a rise. Thanks to its efforts of manufacturing electric vehicles and its components in-house. It has signed an agreement with Ford Motors to develop innovative products in the field of electric vehicles.

Five years before it was standing at Rs 892 and currently valued at 1408 with 57% gain. This makes us believe in the power of equity.

Bharti Airtel

Jio has jolted several telecom companies, but a very few of them like Bharti Airtel has refused to kneel down. Its constant acquisition of towers, spectrum licenses and its marketing strategies will increase the foothold of Airtel.

The only telecom stock which has managed to achieve 64% return in five years, starting with 299 the price has increased to 491 in current trading session.

Conclusion

Although risky but investment in Equity is the best instrument as it helps to battle against the inflationary winds.

Pingback: Best Tax Saving Mutual Funds or ELSS 2018 Comparion and Analysis