The people say that the days of mid-cap and small-cap stocks are over. Blame it on weakening macro indicators and heightened market volatility due to unstable economic conditions but if the experts are to be believed it is a correction phase that has opened a window of opportunities to the investors. Here, are some top mid-cap stocks that are worth investing for.

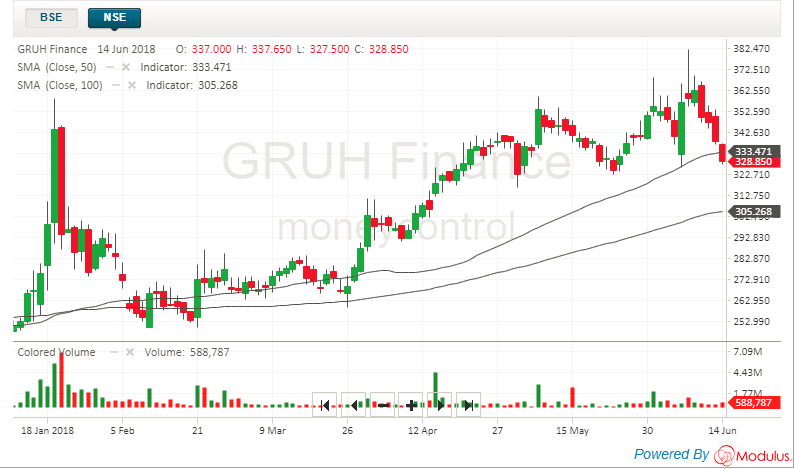

Gruh Finance (NSE: GRUH)

Real Estate Company-the stocks of Gruh Finance is trading high after the board approved the issue of bonus shares in ratio of 1:1 to the shareholders. The company also offered a dividend of Rs 3.30 per equity share with a face value of Rs 2 each. After these announcements, the scrip was lifted up by 5.32%. The stock cheered a little more after PM Modi announced an increase in the carpet area under its PMAY scheme to move more subscribers under its umbrella.

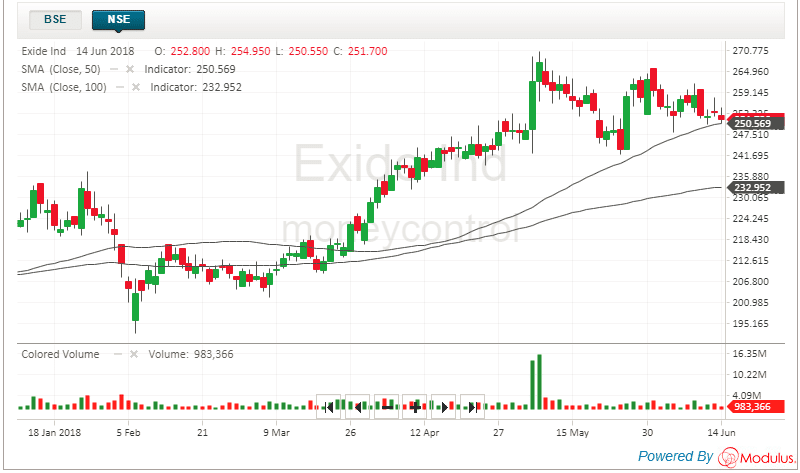

Exide Industries (NSE: EXIDEIND)

A forerunner is lighting up the home with its inverters and batteries, the stock of Exide Industries is believed to spiral upward in the next couple of years because of the correction on OEM and CV segments and stable raw materials prices. The company has benefitted a lot after the implementation of GST scheme but there are certain challenges that remain ahead and due to which the company has registered a net loss. But overall, the stock is worth investing for.

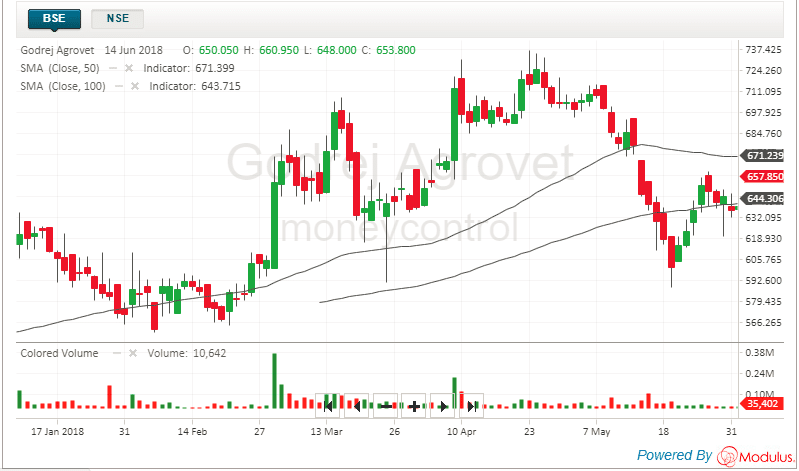

Godrej Agrovet (NSE: GODREJAGRO)

The stock of Godrej Agrovet is on a rise after it announced its quarterly results. The company reported a rise of 7% in the revenue, with a stable margin of 9.4% and EBITDA grew by 18% YoY. However, due to slow growth in the domestic crop production sector, the company’s net profits dipped to 9.5%. However, the stock is worth investing for because right now it is in an expansion mode and plans to acquire Ruchi Soya.

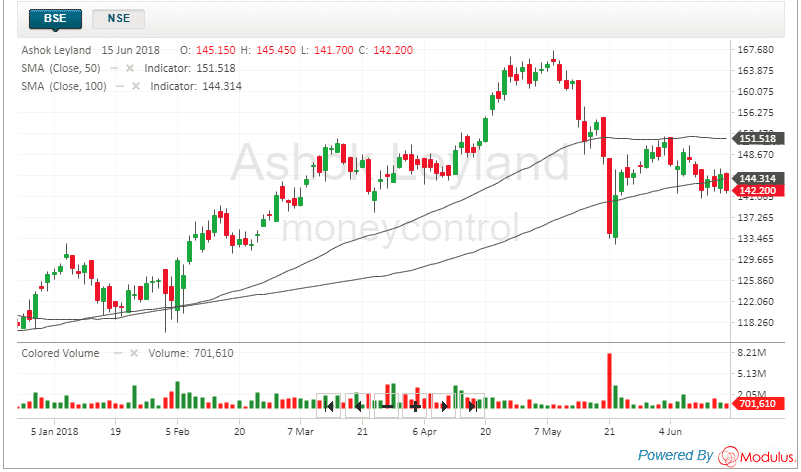

Ashok Leyland (NSE: ASHOKLEY)

There is many positive reasons why you should remain stay invested in this company. Some of them are

Merger of its subsidiaries or consolidation of its LCV business, which will help the company to remain focused on the growth, operational efficiency and better supervision.

Rise in sales- Hinduja group flagship brand Ashok Leyland reported a rise in sales of total 13,659 units.

Both of these factors make this share a worth buy.

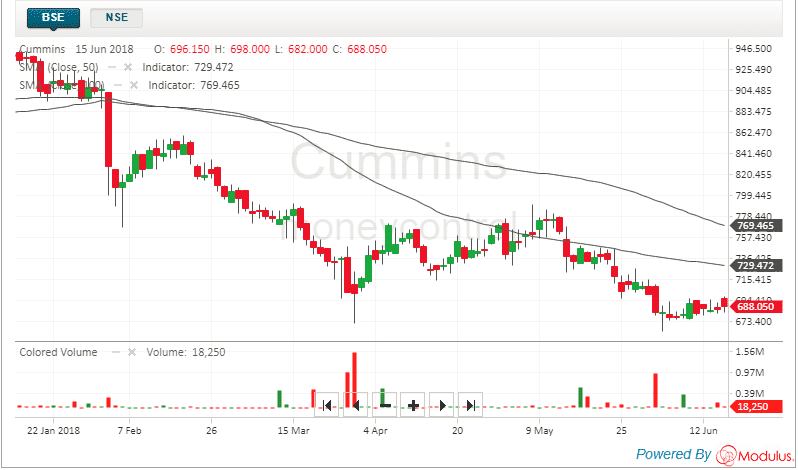

Cummins India (NSE: CUMMINSIND)

The shares of Cummin industries have not been performing for quite a sometime, due to the slow-down in its ROE profile. The unstable economic conditions in India and abroad have led to the dilution in the equity stake. But the experts are confident that the earnings will recover and the company can strike once more with its results.

Invest in Mid-Cap Stocks

In the end, we would like to conclude that the era of mid-cap stocks is not yet over. It is the right time for the investors to reposition their portfolio as the valuations are more favorable now. At the same time the investors should not buy everything lying on the ground, they need to be selective and do research about the company, management quality, profitability, etc. to make the most out of their investments.