The global trade wars between the major economies, spike in oil prices, uncertain political environment, high interest rates, heavy rainfall in the financial capital of India, Mumbai, have made the conditions volatile for the stock market.

Hence, most of the wealth managers believe that the investors should invest in the stocks with reasonably good returns. Here, are top 5 stocks that can prove to be money minting ideas for the investors.

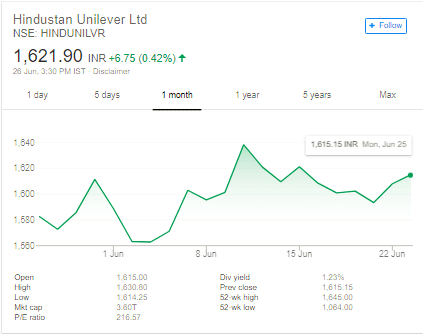

Hindustan Unilever (NSE: HINDUNILVR)

It is one of the largest FMCG Company that offers home care, personal care products to the consumer. As per the research made by JP Morgan, it is believed that the company will continue to command its premium valuation as compared to its competitors. Going forward, the cost-efficiencies of this stock will further improve due to the implementation of GST. In the year 2018, the stock has delivered an exception return of 19.5%.

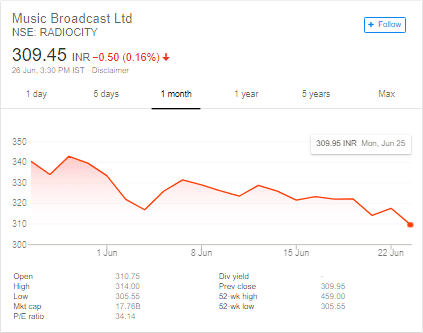

Music Broadcast (NSE: RADIOCITY)

It is one of the oldest radio broadcasters in India offering more than 39 frequencies. The experts are bullish on this stock and believe that the earnings per share of the stock will from Rs 9.06 to Rs 18.743 in the next three years. This also points out a high growth rate of 24.30% per year. The company has a sound financial health.

Crompton and Greaves (NSE: CGPOWER)

Though the company has reported a net loss amounting to Rs 1,166 crore in 2017-18, due to delay in the sale of its loss- making unit in Hungary, but the financial pundits are extremely hopeful that the CG powers consolidated earnings would recover in the years to come.

The continued good performance in the domestic market is an indicator, why the experts are bullish on this stock. Its domestic business has grown by 22% in the year 2017-18. However, short-term pressure will continue on the stock and therefore the investors with long-term horizon should invest into this stock.

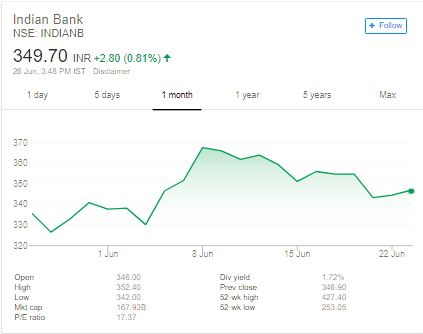

Indian Bank (NSE:INDIANB)

The Indian Bank is one of the best managed public sector bank that has outperformed the private banks too on the different parameters. Recently, the bank has posted the highest profit of 1259 crore, thus topping the chart.

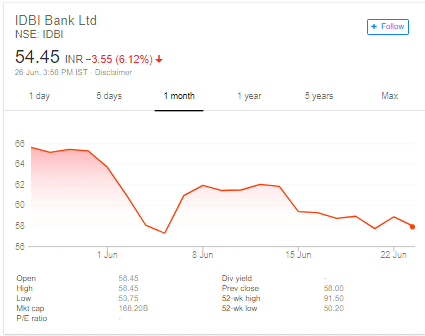

IDBI Bank (NSE: IDBI)

The loss making behemoth has been in the news for quite a while, especially after Vijay Mallaya money laundering case, strikes that opposed privatization, etc. but now it seems the worst time is over for the investors because LIC is soon going to make its foray into the banking segment by acquiring the stake in the bank. LIC has a good team of wealth management, so structuring won’t be of a concern. It is a probably a positive news

In the end, we can say that all these stocks can help you to earn high returns on your investment given its leadership position in the market.